Solar Financing…

No bucks, no Buck Rogers

No solar project, no matter how big or how small, can take place without the availability of financing.

Paraphrasing The Right Stuff:

“You know what makes your projects fly? Funding. No bucks, no Buck Rogers.”

While cash is, was, and always will be king, for many potential solar clients a cash purchase is just not in the cards. Unfortunately, that has led to the growth of some financing methods—like residential leases—that are a great deal for the finance companies, but not such a great deal for the consumer.

Beyond financing methods, rebates and tax incentives are key in determining the profitability of going solar!

Residential Financing Solutions

Residential Solar Loans—the User-Friendly Alternative to Leasing

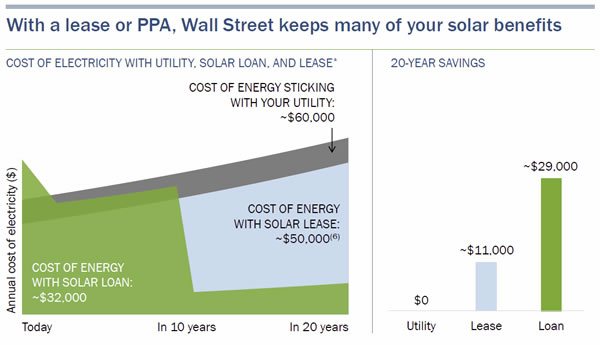

Although leasing has gotten a lot of buzz when it comes to financing residential solar projects, the simple truth is that such programs are often a poor choice for the consumer. As the graph below shows, a solar loan could save you nearly three times as much money over twenty years as you would leasing the same system.

Click for larger image.

So what else aren't the financing companies telling you about leasing? Well…

- The leasing company will pocket both your rebate and the federal tax credit.

- A lease may make it more difficult to sell your home—will prospective buyers qualify for the lease, and will they want to assume that obligation?

- Leases (and especially PPAs) often include escalator clauses that increase your costs every year. If utility costs increase at a slower pace, you could actually lose money.

- Need more? We put together a list of the Top Five Reasons to Avoid a Solar Lease!

Talk about a buzz kill!

Financing your solar project through a loan, on the other hand, lets you keep both the rebate and the tax credit. Depending on your personal credit status, there may be several loan options available to you, including:

- Home Equity Line of Credit—If your credit score is high, and you have equity in your home, chances are that a home equity line of credit (or HELOC) may be your best option, providing the lowest possible interest rate and the most favorable terms overall. Check with your local bank or credit union.

- Solar-Specific Loans—Companies like Mosaic are offering loans specifically tailored to solar projects. You can re-amortize the loan without cost, which allows you to apply those incentives to your loan balance, thereby reducing your monthly payment. Loan terms range from 5 to 20 years, and interest rates vary depending on the loan terms and your FICO score.

We are very excited about solar loans for clients who cannot afford to purchase their system outright. Before you sign on the dotted line for a lease, we urge you to give us a call and let's see if a solar loan on a Run on Sun solar system can save you some serious money.

Property Assessed Clean Energy (PACE) Financing for Residential Solar through HERO

PACE financing for residential projects has become a viable option, thanks to the creation of the HERO (Home Energy Renovation Opportunity) program that began in Riverside county. Now the HERO program has expanded into Los Angeles and Orange counties (amongst others).

The HERO Financing Program provides homeowners a unique opportunity to make home energy improvements through property tax financing. Because the load is tied to the property, it is not dependant on the homeowner's personal credit score. Rather, as long as the property taxes are current and no bankruptcy within the past two years.

Benefits include 5-20 year terms, tax-deductible interest, transferability when the property is sold and consumer protections.

The HERO program launched in Los Angeles County on May 23, 2014 with just a handful of cities. Since that time, the program has expanded dramatically, and now includes more than 100 cities in LA and Orange counties.

Based on the HERO website, here's a list of the participating cities as of January, 2016:

Click to see if your city participates in HERO…

Close

Commercial Financing Solutions

Commercial Leases/Power Purchase Agreements (PPAs)

In a commercial solar lease, the right to use the solar power system is transferred from the owner, referred to as the lessor, to the lessee. From an accounting perspective, all leases are either considered a capital lease (aka a finance lease) or an operating lease. Generally speaking, “capital leases are considered equivalent to a purchase, while operating leases cover the use of an asset for a period of time.”

Run on Sun offers our commercial clients a capital lease to finance their solar project. Contact us for details.

Capital Leases

Under accounting standards, a capital lease is defined as “a lease that transfers substantially all the benefits and risks of ownership to the lessee.” Therefore, with a capital lease, as with a cash purchase or loan, the solar client is treated as the owner of the system and receives the benefits of ownership: utility rebates and tax incentives (if applicable). The capital lease is often for a longer term—the basic criteria is that the lease must run for at least 75 percent of the estimated economic life of the system—that is, 15 years or longer.

The longer term can keep payments lower, but because the solar client lessee receives the rebate and tax incentives, the capital lease might carry a higher interest rate than does an operating lease. At the end of the term, the lessee can typically purchase the system at below market cost, perhaps for as little as a nominal one dollar.

Operating Leases

In contrast, with an operating lease the solar client lessee does not effectively own the system, and the lessor retains the utility rebate and the tax incentives. Rather, the lessee is simply acquiring the right to use the system for a limited time in exchange for periodic rental payments. Typically, an operating lease will be for a shorter period of time, and potentially at a lower interest rate. However, at the end of the lease term the lessee either has the system removed by the lessor, enters into a new lease arrangement, or must purchase the system for fair market value.

Run on Sun does not provide operating leases.

Power Purchase Agreements (PPAs)

A related, but different, vehicle for financing a solar power system is a Power Purchase Agreement, or PPA.

As with an operating lease, solar clients under a PPA do not own the system. Rather, they purchase the energy that the system produces

from the system owner, presumably at a price lower than what they would be paying their utility for the same quantity of energy.

Since solar clients under a PPA only pay for the energy actually produced by the system, the system owner has a greater incentive to maintain the system at peak efficiency, and solar clients may receive more of the “benefit of their bargain” under a PPA than they would under an operating lease.

PPAs typically contain “escalator clauses” by which the price paid per kilowatt hour generated may increase over time. As long as the cost of energy under the PPA increases more slowly than the corresponding utility's energy rates, the solar client's savings will grow over time. However, it is possible under a PPA to end up paying more for energy to the system owner than the client would have paid to the local utility.

Federal Trade Commission Concerns

Being locked into a potentially bad deal is not the only possible concern for lease or PPA customers—they might also run afoul of federal law. The Federal Trade Commission (FTC) is the federal agency charged with regulating false or deceptive marketing claims, and solar leasing options can surprisingly lead to unwanted scrutiny from the FTC. The FTC's concern is “double counting”—multiple entities taking credit for the same environmental benefit. This sort of double counting can occur when a company hosts a solar power system, but does not own it.

The FTC provides the following as an illustrative example:

A toy manufacturer places solar panels on the roof of its plant to generate power, and advertises that its plant is “100% solar-powered.” The manufacturer, however, sells renewable energy certificates [RECs] based on the renewable attributes of all the power it generates.

Even if the manufacturer uses the electricity generated by the solar panels, it has, by selling renewable energy certificates, transferred the right to characterize that electricity as renewable. The manufacturer's claim is therefore deceptive.

It also would be deceptive for this manufacturer to advertise that it “hosts” a renewable power facility because reasonable consumers likely interpret this claim to mean that the manufacturer uses renewable energy. It would not be deceptive, however, for the manufacturer to advertise, “We generate renewable energy, but sell all of it to others.”

Deceptive claims are actionable under the FTC's mandate, and offending companies could be subject to enforcement actions and fines. Under either an operating lease or a PPA (though likely not under a capital lease unless the RECs are surrendered to the utility), the solar client does not own the solar power system, and any claim to be “solar-powered” or “using green energy” would be deceptive under the FTC's guidance.

More about leases, PPAs and the FTC…

Close

Commercial PACE

PACE—which stands for Property Assessed Clean Energy—operates in cooperation with a local government, typically a city or county, that agrees to finance solar power systems through the sale of municipal bonds. Investors purchase the bonds, and the proceeds are used to pay for the installation of the solar power system. The government entity imposes a lien on the property to be discharged after the owner has paid back the system cost over time as an assessment on their annual property tax bills. If the client chooses to sell the property, the obligation “runs with the land” and is assumed by the new owner (who, of course, also derives the benefit from the solar power system). Under PACE, there is no personal obligation on behalf of the solar client, so neither corporate nor personal credit is at issue.

Commercial PACE programs are presently available in most of Los Angeles County, but not (presently) in Orange County. Run on Sun is a participating-PACE contractor and would be happy to help any of our LA County-based clients tap into PACE financing.

Rebates and Tax Incentives

Rebates, provided by the utility, and tax incentives, provided by the federal and state governments, can reduce the out-of-pocket expense of going solar by as much as 40 to 55%. Unfortunately, both rebates and tax incentives are a moving target, with local, state and national policy decisions constantly re-arranging the landscape.

In the sections that follow we will highlight the present state of play for these vital financial incentives.

Rebates

Rebates, whether for commercial, residential, or non-profit projects, have one thing in common—they are paid to the system owner by the local utility. The amount of those payments are governed by either the California Public Utilities Commission as part of the California Solar Initiative (CSI)—for the investor-owned utilities like Southern California Edison (SCE)—or by local city councils—for the municipal utilities like the Los Angeles Department of Water & Power (LADWP).

CSI rebates have tended to be predictable and have tracked steadily downward since they were instituted back in 2007. Unfortunately, the funding for those rebates has been exhausted and they are no longer available.

In contrast, rebates supplied by the municipal utilities—with the laudable exception of those provided by our own Pasadena Water & Power (PWP)—have been all over the lot, in some cases here today and gone tomorrow, with little rhyme or reason—and even less warning.

Regardless of the utility, in California all rebates are of two types: rebates paid in one lump sum when the system is commissioned (known as EPBB rebates), and rebates paid based on actual performance over several years (PBI rebates). In addition to dividing rebates into those two classes, rebate rates are also often affected by the type of utility customer. In particular, rebate rates tend to be highest for non-profit/governmental entities (with possibly even higher rates for low-income housing sites), lower for residential customers and lowest of all for commercial customers. The rationale for the difference has to do with the availability of tax incentives: non-profits don't pay taxes and therefore cannot receive tax incentives. Home owners can capture some tax benefits (though not if they lease their system), and commercial customers can (potentially) access all of the tax incentives.

Here are the rebates available in the Run on Sun service area as of 3/31/2017:

| Utility | EPBB ($/Watt) | PBI (¢/kWh) | ||||

|---|---|---|---|---|---|---|

| (Click to see website) | Residential | Commercial | Non-Profit | Residential | Commercial | Non-Profit |

| Anaheim | Closed | Closed | ||||

| Azusa | Closed | Closed | ||||

| Burbank (BWP) | $0.32 | $0.24 | Not used | Not used | ||

| Glendale (GWP) | Closed until next lottery in July 2017 | Closed until next lottery in July 2017 | ||||

| Los Angeles (LADWP) | $0.25 | $0.30 | $0.95 | Not used | ||

| Pasadena (PWP) | $0.30 | $0.30 | $0.60 | 9.6¢ | 9.6¢ | 19.2¢ |

| SoCal Edison (SCE) | Rebate funds exhausted | Rebate funds exhausted | ||||

Perhaps the most telling conclusion to be drawn from this table is that rebates are becoming more and more a thing of the past, and that PWP customers have a (relatively) sweet deal compared to their neighbors!

More about rebate types: EPBB & PBI

EPBB, or Expected Performance Based Buydown rebates, are generally limited to smaller systems (under 30 kW in SCE territory) and are paid based on the output of the CSI EPBB Calculator. That calculation takes into consideration a number of factors in determining anticipated system performance, including: the products selected (solar modules and inverters), the orientation of the system (pitch and azimuth), shading present at the site, and the geographical location of the site. The calculator outputs a number of results, including the month-by-month expected energy yield of the system, the "CSI rating" of the system in AC Watts, and the CSI rebate. Other utilities generally take the CSI rating and multiply it by their own EPBB rebate rate to arrive at the rebate amount.

PBI, or Performance Based Incentives, are paid over several years (ranging from two to five, and either in monthly or annual installments) based on the actual, measured performance of the system. Since the rebate is tied to actual performance, systems applying for PBI rebates must use a monitoring system that can measure the system's output to the utility's desired degree of accuracy. PBI rebates also incentivize the system owner to maximize production since the rebate payment—to say nothing of the savings provided by the system—is dependent on that production.

Read more about rebates…

Close

Tax Incentives

Tax incentives can be a very significant aid in making solar affordable, but not every consumer can take full advantage of the tax incentives available. There are two tax incentives available from the federal government: the 30% Investment Tax Credit (ITC) and accelerated depreciation. (The state of California also offers accelerated depreciation for solar equipment, but no direct credit like the ITC.)

As a general proposition, non-profits cannot avail themselves of any of these benefits, homeowners can only access the ITC, but commercial clients can use all three. However, the value of these incentives will depend on the individual's own financial situation, and an experienced tax advisor should always be consulted about the applicability of any of these incentives to a particular situation.

Please note: Run on Sun provides this information as a courtesy to our clients and we believe this information to be accurate as of January 2016. However, clients should always consult with their own tax advisor regarding the applicability of any tax-related incentives.

2016 Solar Tax Incentives for Residential Clients

In 2008 the Internal Revenue Code was amended to provide a full 30% tax credit for qualified clients. This includes the cost of equipment as well as related labor costs, and — thanks to bi-partisan legislation passed in December, 2015 — that credit continues through 2019. The "basis" for calculating the 30% credit is the cost of the solar system minus any rebate provided by the utility.

As with any tax credit, its value to you is dependent on your “tax appetite.” Please consult with your tax advisor to determine the value to you of this tax credit.

2016 Solar Tax Incentives for Commercial Clients

For commercial clients, the federal ITC provides a full 30% of the direct cost of the solar power system in the form of a tax credit to the entity that owns the system. The applicability of the ITC to indirect costs—such as deciding to re-roof your building before adding solar—must be decided on a case-by-case basis.

Since commercial rebate payments are generally treated as taxable income for a commercial building owner, the value of the rebate is not deducted from the system cost when calculating the basis for the rebate. (This is the opposite of what typically occurs for a residential solar client since residential rebate payments are generally not taxed; hence, the value of the rebate must be deducted from the system price in calculating the basis for the ITC.)

Since the ITC is a one-for-one reduction in the amount of tax actually owed, it is possible that it might exceed the system owner's tax liability in the year that it is earned. Fortunately, IRS rules allow the excess credit to be carried backward one year (by filing an amended return for the previous year) and forward up to twenty years.

The other important tax incentive for commercial clients is depreciation, by which a taxpayer can deduct the cost of purchased equipment against their net income. As this is written (January 2016), federal law allows an accelerated depreciation schedule to be applied to solar equipment, and some states—such as California—do as well. Since depreciation reduces the taxpayer's adjusted gross income, its cash value is dependent on the taxpayer's overall tax bracket. However, for high-income taxpayers, depreciation can significantly reduce the overall cost burden of adding solar.

2016 Solar Tax Incentives for Non-Profit Clients

Unfortunately, non-profit organizations such as schools, churches, etc., do not qualify for any of these tax incentives. However, despite the lack of tax incentives, Run on Sun has helped numerous non-profits go solar.

Learn more about our approach to solar for non-profits by visiting our non-profits page.

Read more about tax incentives…

Close

NASA cover photo of Apollo 11 launch, July 16, 1969, courtesy Apollo Image Gallery, image 69-H-1134, scanned by Kipp Teague.

Portions of this page were previously published in Commercial Solar: Step-by-Step, ©2013 by Jim Jenal and used here with permission.