Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

February, 2016

Volume: 7 Issue: 2

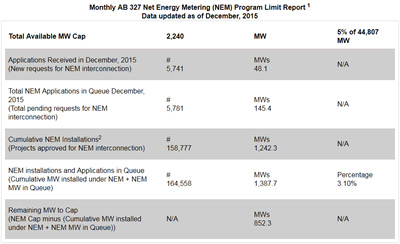

Net Metering 2.0 ExplainedOn January 28 the California Public Utilities Commission (CPUC) voted 3-2 to adopt new rules governing what is known as Net Energy Metering, thereby creating the framework for Net Energy Metering 2.0 (NEM 2.0). Here is our take on what the CPUC did, and didn't do. What Hasn't ChangedThe first and most important thing to know is that for many people, the new rules adopted by the CPUC will not affect you at all! These new rules only directly apply to customers of the three investor owned utilities (IOUs): SCE, PG&E, and SDG&E. If your electrical service is provided by one of the municipal utilities - like PWP or LADWP - nothing that the CPUC did last month will directly affect you since the CPUC does not have jurisdiction over the munis. (That said, the munis often follow the lead of the CPUC, so it is entirely possible that they will individually adopt their own version of NEM 2.0, but that will be a discussion for another day.) Even for solar clients in the service territory of one of the IOUs, if you have already signed a net metering agreement, you will be grandfathered in and allowed to continue to operate under the old rules for 20 years. Once the 20 years have elapsed, you will be transitioned to the net metering rules (NEM 5.0?) then in effect. Beyond all of that, even for new solar clients in IOU territory, these new rules do not go into effect right away. Rather, the old rules will still apply until your utility reaches their 5% of customer aggregate demand cap, or July 1, 2017 - whichever comes first. In SCE territory it is an open bet as to which will occur first (see more below). Bottom line: this is not happening right away, so you still have time to benefit from the existing rules. What is Going to Change

At the other extreme, the "solar parties" (such as CALSEIA and The Solar Alliance) advocated for keeping net metering at full retail value. However, in a nod to changing realities, they did support paying on nonbypassable charges (more on that mouthful in a minute) but not until after 2019. Still, there was one proposal that strikes us as entirely reasonable which CALSEIA opposed - mandatory warranty periods. Back when the California Solar Initiative was in place (i.e., when SCE was paying rebates), solar contractors were required to provide a ten-year warranty on their work in order to participate in the program. With the demise of the CSI program, technically that warranty requirement also went away. As part of the NEM 2.0 rulemaking, ratepayer advocates advanced the notion of restoring the warranty requirement - a common sense request that no one should oppose. But the "solar parties" did oppose it, asserting that such a requirement could "discourage innovation in product offerings." Seriously? What "product" might we reasonably want to offer that having to stand behind it would be discouraging? When pressed about this position during CALSEIA's NEM 2.0 webinar, Brad Heavner, CALSEIA's policy director, said that the view was that the market could decide this: presumably if a company didn't offer a warranty and that was important to the customer, they would go with a different company. This was not, however, a position that CALSEIA pushed hard to win, and in the end, they lost on this point. In our view, opposing a mandatory warranty paints solar in a bad light. It puts the industry on the side of those who do the least reliable work, and penalizes those companies who go the extra mile to install systems that will stand the test of time. From what we have seen it is tough enough to get a company to honor its warranty commitments, let alone relying on the "invisible hand" of the market to protect consumers. CALSEIA did a lot of great work on NEM 2.0, but this position was a mistake. DecisionThe ultimate decision is a major defeat for the IOUs, and a partial victory for the solar industry. For the IOUs, they clearly overplayed their hand, advancing proposals that were so clearly anti-solar that the Commissioners couldn't really take them seriously. According to a CALSEIA webinar, toward the end of the proceedings the IOUs suggested an energy export feed-in-tariff which, if they had proposed it at the start, might have gained traction. Something to think about as we look toward subsequent iterations on NEM rules. The solar industry retained full retail value for energy exports, but they also saw three changes that undercut somewhat the value of that victory: nonbypassable charges (NBC) for all energy taken from the grid, one-time interconnection fees, and mandatory time-of-use (TOU) rates. Let's look at each in turn. Nonbypassable Charges (NBCs)As part of their rate schedules, the IOUs have certain rate components that are known as nonbypassable charges or NBCs. For example, if you were to look at SCE's Domestic Rate schedule tariff page (check out page 3), you would see a whole host of factors that go into making up the rate that the customer ultimately pays. The decision affects three of those NBCs: the Nuclear Decommissioning Charge, the Public Purpose Programs Charge, and the Department of Water Resources Bond Charge. The sum of those three charges for an SCE residential rate payer comes to 2.224¢/kWh. (The lion's share of which is the charge for public purpose programs, such as bill assistance to people on limited incomes.) Under the old rules, solar customers would only pay for these charges on the net energy that they consumed in a month. So, if your consumption was 1000 kWh per month, and your solar system produced 800 kWh, you would only pay these charges on 200 kWh, about $4.45. Under the new rules, however, every kWh that you pull from the grid, whether it is ultimately netted out by energy you exported, is subject to NBCs. Sticking with the same example, of the 800 kWh that you produce, imagine that 500 kWh of that are consumed at your home and the remaining 300 kWh are exported. Meaning that you imported a total of 500 kWh from the grid. As a result, under NEM 2.0 you will pay NBC on 500 kWh — raising the charge from $4.45 to $11.12, and increase of $6.67/month on the solar customer's bill. The relatively small impact of the NBCs is due in part to solar industry lobbying that held the line at around 2¢/kWh versus a proposal, apparently favored by the two dissenting Commissioners, to include more charges that would have brought the total above 4¢/kWh. (Indeed, we are told that keeping the NBCs at 2¢/kWh is what caused those two Commissioners to vote against the final package.) Frankly, we think the NBC costs are fair. The programs supported by the NBCs are a public benefit and all other customers pay for those based on every kWh they pull from the grid. Under the new rules, so will solar customers. Of course, if you are in a lease and only saving $20/month from your old bill, this is a much bigger hit. Yet another reason to avoid leasing! One-Time Interconnection FeesAlso reasonable was the imposition of one-time interconnection fees to be set based on the IOUs actual cost of handling the interconnection. The CPUC estimates that the fee will be somewhere between $75-150. (Recall that SCE advanced a $75 fee as part of its proposal, so it will be fascinating to see if they try to come back for a higher fee now!) Mandatory TOU RatesThe biggest hit to solar mandated by the NEM 2.0 rules was the requirement that solar customers get switched over to TOU rates. (SCE is moving all customers to TOU rates eventually, but that target date is 2019.) Under TOU rates, you pay more for your energy depending upon the time of day when you use it, as opposed to being on a tiered rate schedule where you pay more when you use more during a billing cycle. For residential customers, SCE sets its peak charge time as the hours between 2 and 8 p.m., and Noon to 6 p.m. for commercial customers. This means that, for residential customers, solar exported to the grid before 2 p.m. will be valued less than energy that needs to be pulled from the grid after the sun goes down, but before 8 p.m. It is this change to the rate structure, and to a lesser extent the imposition of the full NBCs, that makes intelligent energy storage that much more valuable. With smart storage, you won't export energy during the day, you will store it for later use. That reduces the total amount of energy pulled from the grid (lowering the NBCs) and allows you to shift the availability of the energy to the evening so as to avoid peak TOU rates altogether. There can be no doubt that this is the future for how solar installations under NEM 2.0 (and likely beyond) will be the most cost-effective. We are optimistic that by the time NEM 2.0 goes into effect for SCE clients in our service area, we will have an intelligent storage solution to offer. TimingSo when does all of this go into effect? As we noted above, at the very latest, the new rules go into effect on July 1, 2017. Most likely, however, they will go into effect sooner than that since the actual start date is tied to when the IOU reaches its 5% cap. The report also shows that applications for 48.1 MW of new solar were received during the month of December. If we take that number as a fair monthly average, we can expect SCE to reach its cap in 17 to 18 months. So to lock-in your system under the existing rules, you will need to have your net metering application complete and on file with SCE before then (May-June 2017). We will continue to update on the status of SCE's progress toward its cap. Final ThoughtsOn the whole, the solar industry dodged a bullet, especially when you look at the latest battles over NEM in other states, like Nevada. This success is a tribute to the thousands of people who took the time to advocate for solar, whether they be our trade association, CALSEIA; individual solar companies, like Run on Sun; or solar customers who reached out to inform the Commission of the true value of solar. Not lost in the debate was the importance of solar as a job creation engine in California. Moreover, the political climate in California, from the Governor on down, has been strongly supportive of solar and they deserve our thanks as well. We would love to hear your thoughts and if you have questions that haven't been answered here, please leave them in the comments and we will do our best to address them. |

“The ultimate decision is a major defeat for the IOUs, and a partial victory for the solar industry…”

Get your copy of

Commercial Solar:

Step-by-Step

from

Run on Sun

Founder & CEO

Jim Jenal

Now available on Amazon.com

in both

Print & Kindle versions.

Bonus - Buy the Print version…

Get the

Kindle version for Free!

Commercial Solar:

Step-by-Step

from Run on Sun

Founder & CEO

Jim Jenal

Now available on Amazon.com

in both Print & Kindle versions.

Get the Kindle version for Free!

Help Us Spread the News!

We use Angie's List to assess whether we're doing a good job keeping valued customers happy. Please visit AngiesList.com in order to grade our quality of work and customer service.

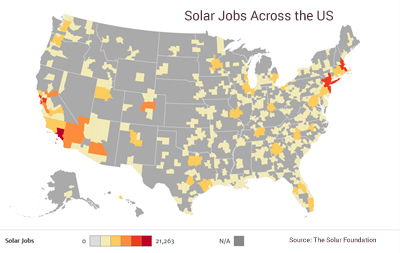

Solar Census: 10% of Solar Workforce is in LA Metro Area!As solar installers here is sunny SoCal (it is 84° headed to a high of 88° as I write this in mid-February), we have the sense that there is a great deal of competition in the Run on Sun service area for solar clients. Well the freshly minted Solar Census 2015 now provides the hard numbers to back up that contention - more than 10% of the entire national solar workforce is located here in the Los Angeles Metro area!

More broadly, that national total exceeds the number of direct jobs in both the nuclear and coal industries. (In the electric energy sector, only natural gas has more direct jobs than does solar.) And those jobs are growing by leaps and bounds - with growth in solar jobs expected to increase by nearly 15%! (No wonder the federal solar tax credit was extended - that's a lot of jobs at stake.) Overall, there are 9,900 solar companies in the US that have installed solar on over 5 million homes. Nationwide, the cost of energy from those home solar systems is just 10.5¢/kWh (comparable to what we see) which compares quite favorably with utility prices that start around 15¢ and go as high as 40¢! We are proud to be a part of this growing movement - give us a call and let's see if we can't help you join the ranks of your five million solar neighbors! |

EVs are Coming - Fast!Here at Run on Sun we are big fans of Electric Vehicles (EVs) - we started writing about them years ago as a natural marriage, if you will, with solar power. We have long had a page on our website devoted to the synergy between solar and EVs, and we drive a Volt as our main company car. But one thing we hear from skeptics is that EVs will never replace gasoline cars - they are too expensive or they are too limited in range (that latter point being why we drive a Volt and not a Leaf). But an interesting analysis from Bloomberg Business suggests that this will change, and far faster than most might think! Check out their very thought provoking video (h/t climatecrocks.com):

Quite the range of opinions on EV penetration - from 1% of new car sales in 2040 (according to Exxon) to 50% in this video. Frankly we are betting with Bloomberg. People who drive EVs have no desire to revert to an internal combustion engine. When you combine that EV with solar power to charge it, you are really getting to a game changer. So what if, as the video suggests, instead of having to regulate away fossil fuels, we just stopped buying them? That future can't get here fast enough! |