Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

February, 2019

Volume: 10 Issue: 2

Solar Bill of Rights Introduced in California Legislature

The legislation, co-authored by Senators Scott Wiener (D-San Francisco) and Jim Nielsen (R-Fresno), has the enthusiastic backing of the Solar Rights Alliance, Vote Solar, and CALSSA. If signed into law, the bill would require both Investor Owned Utilities (like SCE) as well as public utilities (like LADWP and PWP) to make changes to how they handle the interconnection of solar and storage systems, provide for compensation for storage systems that provide energy back to the grid, and report on their progress in streamlining their processes for approving and commissioning such systems. The bill also makes some key findings regarding the value of distributed energy generation and storage systems:

But as we have said in this space often before, politics is not a spectator sport—it takes active involvement to bring about effective public policy. The good news is that we can make it super easy for you to contact your members of the California Legislature and urge them to co-sponsor SB-288. Just click on the friendly button below: Support SB-288

We will keep you posted as to the bill's progress - watch this space! |

“The Solar Bill of Rights - an Idea Whose Time has Come…”

Help Us Spread the News!

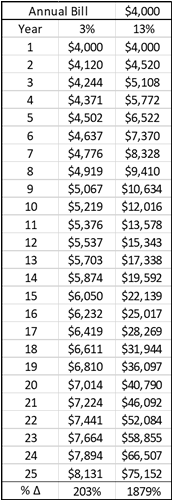

Meet Shortcut Solar!A Shortcut Solar Favorite - the Promise that is Just too Good to be True!Shortcut Solar knows that they won't win your business honestly, so they specialize in making stuff up! Case in point: we had a potential client forward to us a proposal that they had received from Shortcut Solar. The proposal conveniently included the contract, so the consumer didn't need to waste any time signing on the dotted line! (Oh, by the way, that one-page disclosure that is now supposed to be on the front of all solar contracts in California, yeah, it was nowhere to be seen. Way to go, Shortcut Solar!) Glancing over the proposal, one number jumped off the page, cumulative savings after twenty-five years of $331,000!!! Say what? This is a resi project (oversized at nearly 13 kW, another classic Shortcut Solar move), so how on earth could they come up with such an astronomical number? Lurking in their assumptions was the key - they were predicting annual utility cost increases of 13%! To put this in perspective, we use an annual increase of 3%. We decided to mock this up using our proposal generation tool, the fabulous Energy Toolbase, but guess what? You can't, because their tool rejects any value greater than 6% - less than half of what Shortcut Solar was using. (Energy Toolbase prides itself on doing things in an honest and transparent manner - no wonder Shortcut Solar doesn't use them!)

Consumer TakeawaySo here is your consumer takeaway: Look that proposal over carefully, and if those numbers seem too good to be true, you just might be dealing with Shortcut Solar! Have your own Shortcut Solar story? Let us know and we will add it to the collection! |

Enphase Announces Delay in IQ8 Roll-outOn Tuesday, Enphase Energy held their quarterly conference call to report earnings for Q4 and all of 2018. While we don't own stock, to say that we are heavily invested in Enphase would be an understatement! So we listened it to most of the call to get a sense on where things stand for the company. The good news is that financially the company is doing very well, and its stock price has jumped, closing over $9/share for the first time in nearly four years. (A certain Solar Ninja has done extremely well with her Enphase investment!) The not so good news was the delay of the roll-out of the IQ8, the product that we saw last summer in the Enphase lab and which blew us all away. We were hoping to see the IQ8 begin to be available in the first half of this year, but that is not going to happen. Instead, it is now slated to roll-out starting in Q4 of this year. Of course, there is no telling what volume will be available, or at what price point as none of that has been announced. And as Enphase conceded on the call, this is a very complicated system and they need to get it right way more so than get it quickly. Which of course is true—when your reputation is predicated on reliability, you cannot afford to cut corners. So we will bide out time and look forward to seeing a world class product, when it is ready for prime time! |

“The wait for the IQ8 just got longer…”

Get your copy of

Commercial Solar:

Step-by-Step

from

Run on Sun

Founder & CEO

Jim Jenal

Commercial Solar:

Step-by-Step

from Run on Sun

Founder & CEO

Jim Jenal