Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

February, 2015

Volume: 6 Issue: 2

Top 5 Reasons to Stay Away from that Solar Lease!

Reason #5 - You can't get credit on your appraised home value with leased solar panels.As we noted in our recent post about solar ownership boosting your home's resale value, if you don't own the panels on your roof, they aren't an asset toward boosting your home's value. Reason #4 - The "benefit" of covered maintenance is a myth!Leasing companies tout that they cover the maintenance on your solar system, but the truth is that most maintenance is already covered by product and installer warranties. (For example, Enphase microinverters come with a 25-year warranty - longer than the typical lease term.) For most residential system owners the only maintenance their systems need is to wash the panels off with a hose. Reason # 3 - You don't have to be a Geek to own solar!The NPR story suggests that to own solar requires a very "hands-on" approach, with the homeowner being forced to navigate the shoals of rebates, tax credits and permitting on their own. Nothing could be farther from the truth. A reputable, local solar installation professional, like Run on Sun, will handle all of those messy details for you. Reason # 2 - A leased system complicates selling your home!If you decide to sell and you have a leased system on your roof, your prospective buyer has to not only meet your required offer, they also need to satisfy the leasing company's qualifications to assume the remainder of your lease. A buyer might qualify for a mortgage, but not satisfy the credit requirements of the leasing company, and even if they do, they might not be interested in the hassle of dealing with a lease payment for the remainder of your twenty-year term. Reason # 1 - The leasing company is ripping you off!Bottom line, this is the number 1 reason to avoid a lease. But don't take our word for it, let's look at what one of the largest solar leasing companies says, right there in the tiny print on their website:

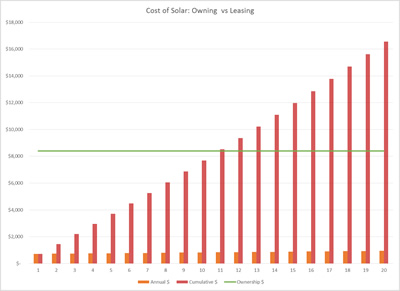

Just how bad a deal is that? Well, let's take a typical 3 kW solar project. That is really small, so the cash price from a local installer is probably around $4/Watt - which works out to $12,000 up front. However, if you own, you receive the rebate (if any) and the tax credit. In PWP territory, that rebate works out to roughly $2,200 but in SCE territory, the rebate is zero. So to take the worst case example for ownership, we will assume no rebate. In that case, the tax credit is worth 30% of $12,000 or $3,600 leaving the ultimate cost to own at $8,400. Now what happens in a lease for that same system? No rebate or tax credit goes to you - the leasing company pockets those. What about your payments? Well, let's take the middle ground suggested in the leasing company's quote above and look at a cost of $60/month in year 1, with an annual increase of 1.45%. While it may be true that not everyone can afford to purchase a solar power system outright, that is changing as solar becomes more affordable for more people. Plus, with the emergence of solar loans, which can provide for little or no out-of-pocket cost while still retaining the benefits of ownership, cash-constrained consumers can still go solar without resorting to the leasing trap. For all of these reasons, and a whole bunch more, we at Run on Sun have never offered residential leases, and we never will. If you want to go solar but avoid the pitfalls of leasing, give us a call - we are waiting to help! UPDATE: Two reports from NREL bolster our conclusions above: "To Own or Lease Solar: Understanding Commercial Retailers Decisions to Use Alternative Financing Models," and "Banking on Solar: An Analysis of Banking Opportunities in the U.S. Distributed Photovoltaic Market". Analysts found that businesses that use low-cost loans to purchase a PV system and homeowners who use solar-specific loans can save up to 30 percent compared with those who lease a system through a third-party owner. |

“ By the time the lease ends in year 20, the solar leasing customer will have paid nearly twice what the system purchaser paid, and they still will not own the system on their roof!…”

Get your copy of

Commercial Solar:

Step-by-Step

from

Run on Sun

Founder & CEO

Jim Jenal

Now available on Amazon.com

in both

Print & Kindle versions.

Bonus - Buy the Print version…

Get the

Kindle version for Free!

Commercial Solar:

Step-by-Step

from Run on Sun

Founder & CEO

Jim Jenal

Now available on Amazon.com

in both Print & Kindle versions.

Get the Kindle version for Free!

Energy-Efficient Homes are Hot!

But there is hope! The trend toward more efficient homes in the housing market is already getting attention. After surveying both home builders and home buyers, the National Association of Home Builders (NAHB) reported that Millenials want energy-efficient appliances and features as well as smaller homes. Smart technology such as programmable thermostats will also become the norm. Respondents said they were willing to pay 2-3% more for better energy-efficiency if they could see a return through lower electric bills. Respondents also said they'd be happy to sacrifice extra finished space for a more affordable first home. If you are a home owner you should be tapping into the energy-efficiency trend to not only lower your utility expenses but improve the marketability and value of your home. If you follow our blog you may have seen our recent post discussing new evidence supporting the idea that solar increases property values. While installing a solar system is the granddaddy of all home energy-efficiency projects, we at Run on Sun always encourage clients to address low hanging fruit first, and make sure your energy usage is as low as possible. This will lower the size of the solar system you need to offset your usage, and thus, the overall cost of your solar investment. Way too much of the energy we consume is wasted through poor insulation, leaky ducts, or inefficient household appliances. Fixing these problems can cut energy costs up to 25% for the typical home. One option is to ask a professional energy auditor to find exactly where your energy is going (we have some folks we can recommend). However, many energy saving tips are intuitive...installing double pane windows, better insulation, CFL or LED light bulbs, and ENERGY STAR appliances are all ones you've likely heard before. Others may be lesser known such as using power strips to avoid vamping power. And if you have a pool, upgrading that antiquated pool pump could save you a lot! Once your home is up to snuff, going solar is a great investment to make your home even more desirable in the current housing market. Call Run on Sun today for a free site assessment! |

Solar Women Bring It! …to the NationWISE Roundtable

The issue is this...Women make up 47 percent of the U.S. workforce overall, yet only represent 21 percent of the solar industry, according to the 2014 solar jobs survey (check out Run on Sun's blog summarizing the census by the independent nonprofit Solar Foundation). The challenge to equal representation is two-fold. While it is difficult to attract women to an industry comprised of heavily male-dominated fields - engineering, construction, and sales - it's also a considerable challenge to retain them. They frequently leave the industry to seek more supportive career environments elsewhere. So why does it matter?

This is all fairly anecdotal of course... I have yet to see any studies providing solid evidence on the matter. However, we at Run on Sun believe a gender balance brings a diversity of skills and assets to any team. We are certainly proud to have one of the few NABCEP certified female PV installers as our chief electrician. Not sure if it's her gender that makes her supremely committed to making each project beautiful down to every minute detail, but it certainly doesn't hurt. Whether in customer acquisition, installation, or management, qualified women and men both have a lot to offer.

|