Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

March, 2014

Volume: 5 Issue: 3

Net Metering Gets 20-Year Reprieve

When Governor Brown signed AB327 last October, one thing was clear: net metering as we presently know it was going to go away, we just didn't know how soon. Now, thanks to a ruling on March 27 by the California Public Utilities Commission (CPUC), we know: 20 years. Here's the scoop. BackgroundAround the country, utilities have been pushing hard against net metering—the tariff under which solar customers receive credit for surplus energy production (say during the day when no one is home or on a weekend when a commercial facility is dormant) that offsets energy consumed from the grid (for example, at night). The solar customer's bill reflects the "netting out" of those two quantities (total energy exported versus total energy imported from the grid) and the customer only pays for the difference. If the solar customer is a net energy producer (quite rare), the utility has to cut the customer a check for the surplus. (Unless you are an LADWP customer, sorry.) Last year's bill sought to end the squabbling and provide certainty to solar customers. CPUC's RulingUnder the law, the CPUC is required to devise a replacement for the current net metering arrangement, but yesterday's ruling does not disclose what that will be. Instead, the ruling establishes a sundown provision for customers who are either currently, or will become net metering customers under the current rules before July 1, 2017 (at which time the present net metering rules will be closed to new participants). Solar system owners will be entitled to operate their systems under the net metering rules for a full 20 years from the year in which they interconnect their system. That, decided the CPUC, will provide sufficient time for solar customers to recoup their investment. However, solar customers can transition to the new rules, whatever those may turn out to be, sooner at the customer's election. The year of interconnection is determined by the date on the Permission to Operate letter received from the utility, and the twenty-year term ends on the last day of the twentieth year. System ModificationsWhat happens to systems that are modified after July 1, 2017? Does the new portion of the system get its own 20-year net metering extension or is it simply subsumed into the term for the original system? The CPUC split this into two possible scenarios: repairs or modifications that did not increase system capacity by more than 10% of the original design will operate under the original 20-year term, neither resetting or ending it. But system changes beyond the 10% limit will either have to be metered separately, or the entire system will have to be transitioned to the new tariff structure. Change of Ownership or LocationThe next question to be resolved was what happens if the system is sold or relocated? After all, many solar customers purchase systems expecting it to increase the value of their home—but if the sale eliminates the net metering agreement, that added value could be lost. The utilities, of course, disdained any such concerns, arguing that the net metering term should be tied to the original owner only. Fortunately, the CPUC sided again with solar system owners. Thus, systems will remain under net metering for the full twenty-year term, regardless of changes in ownership, as long as the system remains at the original location. However, if the system is physically moved to a new location, the CPUC deems that to be a new interconnection and the old net metering agreement would no longer apply. Energy Storage SystemsThe decision yesterday also took an important step in addressing the impact of adding energy storage systems to an existing solar system operating under the twenty-year net metering rule. The CPUC ruled that "to the extent that energy storage systems are considered an addition or enhancement to a renewable electrical generation facility utilizing a NEM tariff, we find that they should be treated in the same way, and subject to the same transition period, as the underlying renewable generation system to which they are connected." IOU ReportingThe July 1, 2017 deadline is an absolute cutoff, but the actual end of new net metering agreements can actually be reached sooner if the utility in question has reached its "net metering cap." The CPUC previously set the cap at 5% of the utility's "non-coincident aggregate peak load." To allow perspective solar customers to know if their utility is going to hit that peak before the July 1, 2017 deadline, the CPUC ordered the three IOUs to report to the Commission (and on the utility's website), on a monthly basis, their progress toward that cap. Required DisclosuresFinally, the ruling addressed whether solar installers should be required to provide prospective clients with disclosures about the ruling, specifically as to the duration and limitations on existing net metering agreements. According to the decision, IREC and SEIA opposed such a requirement on the grounds that it exceeds the authority of the CPUC. As a legal matter, that may well be true, but SEIA's position strikes a sour note. Frankly, the solar industry is in serious need of mandated, standardized disclosures on everything from system components, warranties, energy yield, true costs, etc., to say nothing of issues surrounding the changes to net metering. SEIA should be producing model documents for its member installer companies to use and drafting model legislation to mandate their use. In any event, the CPUC punted the requirement issue for installers, saying:

Of course B&P section 17500 is entirely generic and provides no guidance as to what disclosures solar companies should provide to their potential clients. Clearly this is an area that requires legislation and California, as the most mature solar market in the country, should be leading the way here. As for Run on Sun, we will revise our Return on Investment materials to reflect a 20-year window instead of the 25-year model we have used previously. Hopefully that will provide clients with a more accurate estimate of their true ROI. |

“Solar system owners will be entitled to operate their systems under the net metering rules for a full 20 years from the year in which they interconnect their system…”

Get your copy of

Commercial Solar:

Step-by-Step

from

Run on Sun

Founder & CEO

Jim Jenal

Now available on Amazon.com

in both

Print & Kindle versions.

Bonus - Buy the Print version…

Get the

Kindle version for Free!

Commercial Solar:

Step-by-Step

from Run on Sun

Founder & CEO

Jim Jenal

Now available on Amazon.com

in both Print & Kindle versions.

Get the Kindle version for Free!

Help Us Spread the News!

The (Rebate) Party's Over—SCE Imposes Residential Wait List

Who waits until mere hours before a deadline to announce the deadline? Why not simply announce it after the fact and be done with the drama? So what does this mean? It means that as of now, residential CSI rebates in SCE territory are no longer guaranteed. Of course, at 20¢/Watt they were nearly gone for a while now, but this makes it official. Presumably non-residential rebates are still available, but it sounds like SCE will ask the CPUC for permission to tap that piggy bank and shift some or all of those funds to the residential program. If you are a commercial, or more significantly, non-profit entity considering going solar, you better act quickly before those moneys disappear as well. |

LADWP Announces... Hope?Last week LADWP responded to its critics by announcing major changes in how its solar program works. In a widely distributed press release, LADWP said its actions were "aimed at reducing delays, streamlining the program, and increasing transparency." Or in other words, providing participants with some hope that one of the most difficult jurisdictions in which to install solar might finally have a chance to live up to its potential. Here's our take. There can be no doubt that LADWP is in serious need of improving how its solar program works. Indeed, earlier this month we wrote a piece about Why "Soft Costs" are so Hard (particularly in LADWP territory) and in January we wrote in LA: Where Good News goes to Die, how the LA Department of Building and Safety insisted upon adding their own, entirely redundant, testing regime on new solar products, thereby delaying their introduction in the City, even though those products were UL listed and approved for use everywhere else in the State of California by the California Energy Commission. At the time we appealed to LA's new major to fix this:

Now we have no idea whether anyone at LA City Hall reads this newsletter, and we are certainly not the only folks who have been speaking out about the problems in LA, but last week's announcement does appear to have picked up on these themes. Here's how LADWP's new General Manager framed the issue:

To which we say, bravo, but the devil is in the details. So what exactly is LADWP promising to do? Quite a bit, apparently, including (from the press release):

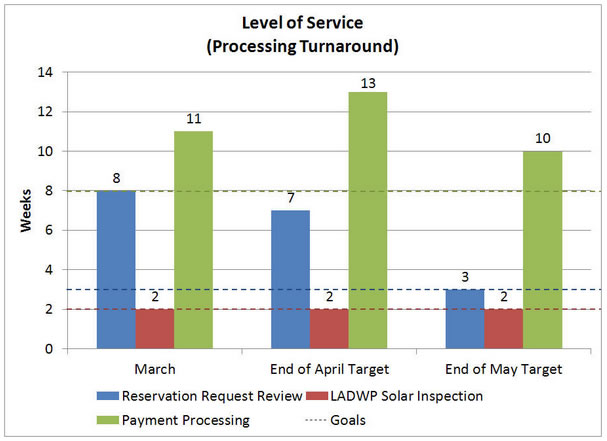

These are all good steps, but if folks who are brought in to review applications don't understand what they are reviewing, then simply having more bodies will not improve the process. Maybe DWP could bring some actual installers into the training process. Why not pay them to sit down with your new hires and go over the materials being submitted via PowerClerk so that there could be a better understanding of what those materials mean? I'm guessing you could get some volunteers to assist with this process, for a price, and that would improve things for everyone. In any event, to help increase the transparency of these efforts, DWP is also creating what they are calling "two Mayor's Dashboards to keep customers informed of the progress and improvements" to the program. These dashboards are to be updated weekly—here is a portion of the dashboard as of March 24:

This shows that the delay in getting a rebate reservation reviewed is presently two months or 56 days—which would in and of itself be a significant improvement on the 78 days we recently endured. By the end of April, DWP is hoping to shave another week off of that and by the end of May to have cut it all the way down to just three weeks, which would bring DWP in line with its neighbors in SCE territory. Unfortunately for those unhappy customers awaiting a rebate, your delays will get worse before they get better, with payments taking a full quarter of a year by the end of April. Ouch. The announcement was not confined to just improvements at LADWP, apparently Building and Safety is also getting into the act. Again, from the press release:

Heavens, be still my heart! Who knows, perhaps someday soon we will be able to skip the whole, "LA has to test everything itself just because it can," phase and be allowed to deploy best-in-class technology as those products become available on the CEC list—just like we now can in every other jurisdiction. (Along those lines we have heard that the Enphase M250 has been approved and that the final certification should issue shortly. Finally.) All and all, these are very encouraging noises coming from the City of Angels, and we can only hope at this stage that positive changes will match the promising rhetoric. |