Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

November, 2013

Volume: 4 Issue: 11

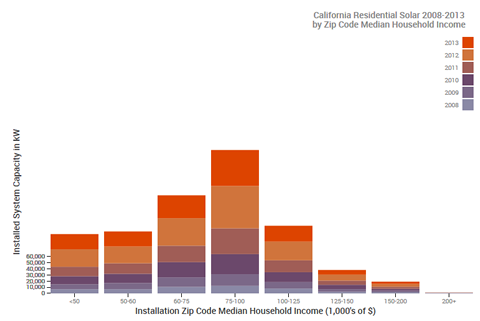

A Word of ThanksThanksgiving is just behind us and it seemed like a fitting time to take a moment and offer a word of thanks to those of you kind enough to take the time to read this Newsletter. So here are some of the things for which we are grateful this year: We qualified for the Chase Grant—We reached our goal of convincing 250 of our supporters to go online and vote for us in the Chase Bank, "Mission Main Street," grant program. Now if you run a restaurant, getting 250 people to vote for you is easy - just set up a laptop at the counter and let people vote right there. Same if you run a gym or a bookstore, or pretty much any other brick and mortar type of enterprise. But Run on Sun is a bit more "virtual" than that - except when we are actually installing a project, we interact with our clients mostly electronically. Nor do we operate a store front for "drop-ins" by the public. (Not yet, at least!) So we needed to reach out to folks electronically and cajole them to take a moment and visit the Chase website to vote. Yet even that wasn't easy - since the only way to vote was to login using your Facebook account and some of our supporters don't have Facebook accounts (?!?) and others are reluctant to trust the assurances of Chase that they will respect their privacy (we hear that). So we are truly grateful for those of you willing and able to vote. Of course, that doesn't mean that we have won - we won't know that until January. Watch this space! We published our book—At the start of the year we set out to publish a book about Commercial Solar and after many months of work we were able to deliver on that goal. The book, Commercial Solar: Step-by-Step, has gotten great reviews—including one by none other than Tor ("Solar Fred") Valenza published over at Renewable Energy World that described it as a New Solar Sales Bible - wow! As a result, we have sold copies of the book not only here in California, but all across the U.S. and even in Great Britain and Germany (isn't the Internet grand?). While the book's focus is on how building owners/managers can profitably install commercial solar, much of the text applies equally well to residential solar projects. Oh, and we hear it makes a great Holiday Present—just sayin'! We have our largest project pipeline ever—As we come to the end of the year, our project pipeline is the largest we have ever seen. We are closing out 2013 strong, and we are looking forward to our best year ever in 2014! We are well on our way to rolling out a shiny new website—Part of our excitement for the New Year ahead is the rollout of a brand new version of our website. The current website—which dates back to 2010—has evolved over the years but the underlying design had gotten to look pretty "clunky" to quote one dismayed supporter. The new website will feature an entirely new look with a much simpler layout and cleaner design elements. Plus, we have been hard at work applying our analytical skills (thank you, D3) to developing intriguing, and maybe even fun, functionality to delight and inform you! (For a sneak peak at one of those features, click the image below.) None of this would have been possible without the support of our many readers and clients. Together, you have given us the ability to make the world a better place, one rooftop at a time. You are why we do this, and we are mindful of your support every day. Thank you! |

“You are why we do this, and we are mindful of your support every day…”

Get your copy of

Commercial Solar:

Step-by-Step

from

Run on Sun

Founder & CEO

Jim Jenal

Now available on Amazon.com

in both

Print & Kindle versions.

Bonus - Buy the Print version…

Get the

Kindle version for Free!

Commercial Solar:

Step-by-Step

from Run on Sun

Founder & CEO

Jim Jenal

Now available on Amazon.com

in both Print & Kindle versions.

Get the Kindle version for Free!

Help Us Spread the News!

Aw Geez, Fox News is at it Again!Years ago, Archie Bunker - of All in the Family fame - would look over at his daughter and son-in-law locked in an amorous embrace and bemoan, "Aw geez, they're at it again!" Well, a recent Fox News story attacking solar has us feeling Archie's pain.

Case in point is this Fox story about questions being raised about SolarCity and its financial dealings, bearing the circuitous title: Solar firm linked to Obama donors could be 'next Solyndra,' top GOP Sen. warns. Wow - how about that for connecting some dots - SolarCity, linked to Obama, linked to Solyndra - a trifecta of irrelevance! (In an interesting tell, it turns out the story is filed under "Politics" which probably tells you all you need to know.) What is this really about? It turns out that Senator Jeff Sessions (R-AL), ranking Republican on the Senate Banking committee, sent a letter on Monday to Treasury Secretary Lew, asking some pointed questions about how SolarCity determines the value of its systems for the purpose of claiming the 30% federal investment tax credit. Fair enough, as far as that goes, since many in the industry have raised questions about SolarCity's practices in that regard. (Anyone who follows this blog knows that we have expressed our own concerns going back several years including this piece from 2011 and this one from 2012.) But it is the spurious - and frankly quite tortured - connections to Obama and Solyndra that are most annoying. First of all, as SolarCity itself was quick to point out, Solyndra failed because it bet that high silicon prices would make solar panels that were dependent on large amounts of silicon ever more expensive. Their design required less silicon to produce comparable power output - a clever idea if the premise were to hold true. But it didn't - silicon prices plunged and panel prices followed. Suddenly Solyndra's products found themselves priced out of the market and the company failed. As we have noted before, smart investors with political leanings on both sides of the aisle backed Solyndra. Yet it is that very drop in prices for solar panels that has fueled the growth of the installation industry - and SolarCity with it. Say what you will about Solyndra, but what pushed them out the door has propelled SolarCity to dramatic growth in its stock price since the start of the year, nearly quadrupling from $12 in January to $47 as this is being written. Second, the assertion that SolarCity has lost millions despite receiving tax credits represents two accurate statements that have nothing to do with each other. They are placed together simply to suggest some sinister linkage in the reader's mind. SolarCity has lost money, like many other start-ups do, while it expands its business model. Part of that model is installing solar systems and then receiving the investment tax credit - just like everyone else who installs a solar power system does. There's just nothing sinister there. It is the equivalent to saying that they have lost a lot of money, despite their customers having paid them millions. This is nothing more than the difference between revenue and profit. Will SolarCity ever turn a profit? Not at all clear, but then, lots of savvy investors think that is a bet worth making. Finally, the reference to "Obama donors" is just plain silly. For example, the Fox article asserts that Elon Musk - Chairman of the Board at SolarCity - donated $750 to Obama's first presidential campaign. Really? Seems like awfully small potatoes for a man with Musk's money. And of course, it isn't accurate at all. According to the brilliant Open Secrets website operated by the Center for Responsive Politics, Mr. Musk has donated freely to both political parties, with donations of $212,750 to Democrats and $211,500 to Republicans going back to 2003. From what we can see, he actually donated $7,300 to President Obama, but he also gave $2,000 to President George W. Bush and $5,200 to Senator Lindsey Graham. (Perhaps he should have donated something to Senator Sessions!) Far and away his largest contribution total is to the National Republican Congressional Committee - $150,900 since 2003 with $32,400 just this year. Seems unlikely that he made those contributions at President Obama's behest, but Fox can't be bothered to tell people that. No, this is nothing more than Fox News trying to push as many buttons as it can with its base and using Sessions' letter to attack, yet again, the value of solar energy to this country and the world. The public deserves better. |

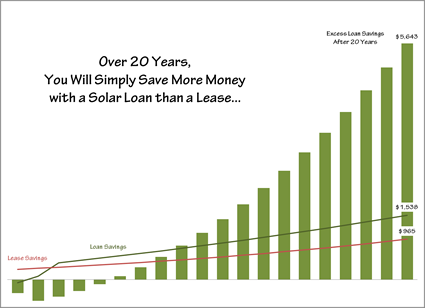

Residential Solar Loans from Run on SunWe have expressed skepticism over the value of solar leases for residential clients in the past and, as a result, we have refused to offer them. Unfortunately, for some perspective clients, something was needed between a straight-up cash purchase and the siren song of the solar lease. Now we have an answer - the solar loan.* Run on Sun is now able to offer qualified residential clients a $25,000 secured loan with the option to also include up to $15,000 more in an unsecured, 18-months same-as-cash plus loan. Together, these two loan options provide for as much as $40,000 for solar power systems - enough for 95% of all residential solar projects. The first piece of the financing mechanism is the $25,000 step-down loan. Under this program, which is open to residential clients with FICO scores of 650 or more, the client has the option of re-amortizing the loan once within the first 24 months - after the rebate and tax credit payments have been received. This allows the client to take advantage of those incentives - as opposed to surrendering them to the leasing company - and use some or all of those proceeds to lower your monthly payments. In addition, there are no pre-payment penalties and the interest is most likely tax deductible - unlike lease payments (but please, check with your tax advisor). The second piece is the $15,000 plus loan for systems larger than 5-6 kW. This loan requires a FICO score of 700 or more, and no payments are required until 18 months from the date of funding. The intent here is that for larger systems, no payment is made on this second loan piece until the rebate and tax incentive have been received, at which time they can be used to pay off this part of the loan. In this way, qualified homeowners can purchase larger systems without increasing their monthly payments. So why is this better than a lease? For one thing, the loan terms are more flexible than many leases, allowing the homeowner to choose repayment periods from five to twenty years. (Of course, the shorter the term and the better your individual credit, the better the interest rate will be.) Another benefit is that your payments are fixed; there are no escalator clauses in this loan, thereby eliminating the fear that your payment could increase faster than utility rates, possibly destroying the value of your system - no such assurances with leased systems. And because you own the system, if you decide to sell your home there is no qualification issue to worry about with potential buyers. But here's the best part - you will save more money with a loan than you will with a lease! Don't believe me? Take a look - let's suppose you need a 5 kW system and you want to pay for it over twenty years (the same terms as most leases). Your credit is very good, but not outrageously good (say, somewhere between 725 and 759), and you are presently averaging $0.22/kWh to SCE. We will assume you are in a 30% tax bracket and we will estimate SCE's rate increases, conservatively, at 4.5%/year. (Note that some leasing companies use 6% or higher - making their numbers look better than they might really be.) That works out to a loan amount of $22,500, give or take. How do your savings compare over 20 years? Take a look: Because you are able to apply your rebate and tax credit to the loan - as opposed to simply handing those over to the leasing company, your loan payment steps down in Year 2. By Year 6 the loan has saved you more money than the lease, and that differential continues to grow year after year. By the time the loan is paid off and the lease term ends, you will be $5,600 ahead having chosen a loan over a lease! (Of course, these are estimates only, your mileage may vary!) If you are looking to go solar but need a financing vehicle, we strongly encourage you to consider the loan option. Give us a call today and let's help you run some number and get you started on a solar project that will maximize your benefits! *Solar loan financing provided through Admirals Bank, Equal Housing Lender, Member FDIC. |