Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

June, 2013

Volume: 4 Issue: 6

Swan SONGS, Solar Spikes

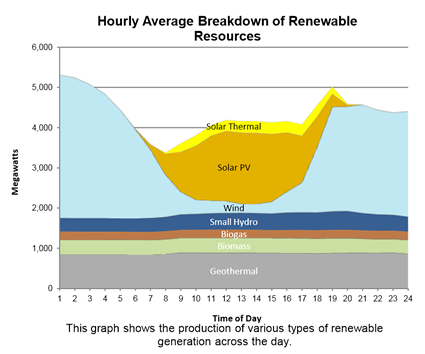

Before it was shut down over safety concerns in January, 2012, SONGS was capable of producing 2,200 MW of power onto the grid, enough to power approximately 1.4 million Southern California homes. When the plant was taken offline, it created a large gap in the energy mix for the region and an old, gas-fired power plant in Huntington Beach was brought online to support the region - adding conventional air pollution and expanded CO2 emissions along with it. What a difference a year makes. From the press release issued the same day that SCE was announcing its decision, the California Independent System Operator (CALISO) reported that solar power peaked at 2,071 MW at 12:59 p.m. and noted:

Remarkable indeed - doubling solar power production in under a year. And keep in mind that these are the solar resources administered by the ISO - that is, utility scale solar power plants. Not reported in that peak production is all of the rooftop solar around the state, helping to hold down power demands while simultaneously lowering customers' bills.

Thanks in large part to the addition of more renewable sources, along with improved transmission infrastructure, the Huntington Beach facility is not expected to have to burn fuel this summer to stabilize the grid. (H/t, Devra Wang at NRDC.) |

“This new record is remarkable considering the amount has more than doubled since last September when solar peaked at 1,000 megawatts…”

Help Us Spread the News!

Burbank Rebate Program Re-opens Via Lottery

The program will pay rebates to residential customers at $1.28/Watt (CEC-AC) and $0.97/Watt for commercial customers. There is no carve out for non-profits, however they say that such entities "will be given lottery priority." Burbank says that is anticipates having enough funding for 50 residential and 10 commercial projects, with the allocation evenly split between the two. That figures to be around a total of 500 kW, 50 residential at 5 and ten commercial at 25 kW each. Surely the demand in Burbank is greater than that, so how will they handle the inevitable over-subscription? Easy - Burbank is holding a lottery. Throughout the month of July, applications can be delivered to the offices of Burbank Water & Power. Then, on August 12, 2013, Burbank will hold a lottery and application numbers will be selected at random. (Not sure how that squares with giving non-profits "lottery priority".) The lucky few winners will be notified by August 16, 2013. "Winning" applications will have 1 year to complete their installation. Questions about the program can be addressed to Solar Support Program Managers John Joyce or Alfred Antoun. Not a great program by any stretch, but at least, for a while, Burbank is back in the game. |

Financing Commercial Solar: Step-by-StepInstalling a solar power system is a major investment, and part of what determines your return on that investment is how the system is financed. In this three-part excerpt from our upcoming book, Commercial Solar: Step-by-Step, we explain the most common methods for financing a small to medium-sized commercial solar power system. In recent years a great deal of creativity (some would say perhaps too much creativity) has been brought to bear on the subject of how to finance solar systems resulting in the introduction of myriad financing schemes from the terribly simple (straight cash purchase) to the terribly complex (e.g., flips and swaps) - and as the amount of money at stake grows, the more complex the schemes become. Fortunately or unfortunately, in the realm of small to mid-sized commercial solar systems, the options are more limited and include cash purchases, loans, various types of leases, Power Purchase Agreements (PPA's) and a handful of more novel approaches. In Part 1 today, we will look at the pros and cons of cash purchases and loans. Part 2 will explore leases and PPA and Part 3 will conclude with a handful of novel approaches and overall limitations. Cash or Self-Financed PurchasesThe simplest financing method is the cash purchase - simple, that is, if you have the cash on hand and it isn't needed elsewhere. When a company self-finances through a cash purchase, they own the system outright and receive the rebate payment from the utility and all of the tax benefits. For those entities with the cash on hand, a cash purchase may be the best possible option since, unlike all of the other methods available, there is no added cost to the price of the system. Instead, a solar power system that is purchased outright should be looked at in terms of its opportunity cost. That is, what advantage/disadvantage does the solar investment provide compared to where the same capital could have otherwise been invested. These days, with interest rates at historic lows, capital invested in traditional savings instruments - savings accounts or certificates of deposit (CD's) - provide safety, but returns in the 1-2% range - not terribly attractive. On the other hand, investments with higher returns - individual stocks or stock funds - come with substantial risk, as the crash of 2008 painfully reminded us. As a result, a solar power system - with next to no risk and an IRR of 12-19% - compares quite favorably. Put most simply, a safer investment will provide a far, far worse rate of return whereas an investment with a higher yield will be far, far riskier. When viewed through such a lens, a solar power system becomes a very attractive investment indeed. In fact, when analyzed in that fashion, investing in solar even makes sense as a way of employing endowment funds designated for the maintenance of non-profit organizations like private schools and churches. LoansUnfortunately, not every entity that would like to add solar is in a position to self-finance. For those who must seek other financing sources, a conventional loan is the obvious alternative - if it is available. While interest rates remain at historic lows, many banks are historically reluctant to make loans at all, let alone for "exotic" projects like solar power installations. Or if they are willing to consider it at all, they may impose onerous terms or prohibitively restrictive conditions that keep solar loans more of a theoretical option than a practical one. Bankers are focused on collateral and cash flow considerations, with solar being strong on the latter but notoriously weak on the former. Normally a loan for an equipment acquisition could be collateralized by the equipment itself - if you don't pay on your car loan, for example, the bank simply repossess the car. But repossessing a solar power system is a complicated project and, unlike a used car which has a known resale value, the resale value of used solar equipment is uncertain, at best. On the other hand, solar power systems significantly enhance the cash flow situation of the loan customer since the combination of remnant electric bill and loan payment will be substantially less than the old electric bill, with that difference only improving over time. In the end, it comes down to a question of the banker's comfort level with solar. Does the reduced risk that the customer will default thanks to the improved cash-flow prospects outweigh the downside increased risk of poor or no collateral? Some banks are starting to emerge with a specialized practice in solar loans but for the moment, loans for small to mid-sized commercial solar projects remain painfully hard to come by. The series continues with Part 2: Leases and PPA's. The preceding is an excerpt from Jim Jenal's upcoming book, "Commercial Solar: Step-by-Step," due out this Summer. |