Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

February, 2013

Volume: 4 Issue: 2

It's On - PG&E Declares War on Solar!

Here's her take:

Frankly, this is simply nonsense. All customers, including those who install solar and use net metering, are billed the same way to cover the costs mentioned by Ms. Burt. But here's the thing, the amount of that payment is tied to energy usage - the more kilowatt-hours you consume in a billing period, the more you pay for grid maintenance. Is that the proper way to cover the cost of fixed assets? Perhaps not, but one thing is for sure, it wasn't the solar customers who designed PG&E's rate structure. So guess what? If you invest in LED bulbs for your home or a more efficient HVAC system on your commercial building, you will lower the amount of energy you consume - and hence you will lower the amount you contribute to covering these same costs. Is that also unfair? As we reported at the time, the California Public Utilities Commission (CPUC) is performing a study now to try and assess the true cost-benefit equation from solar net metering and recently the folks at Vote Solar commissioned their own study which found a net benefit to all ratepayers - including those who do not install solar. Ms. Burt dismisses those results as "predictable" - that is biased - without ever bothering to point out that the state's public utilities, including PG&E, had previously released their own study, with just as "predictable" results. Regardless of how the CPUC's study turns out, Ms. Burt makes clear that PG&E is going to continue their assault on solar: "PG&E is working with the CPUC and Legislature to find solutions for customer solar installations that mitigate or eliminate these cross-subsidies from nonsolar customers to others." Translation? "We intend to do everything in our power - using ratepayers' money - to eliminate net metering!" In PG&E's view, they should receive any excess energy production from solar customers - which they immediately sell to the solar customer's neighbors at full retail rates - for free. Nice deal if you can get it - but is that fair? Of course at bottom is the simple truth that solar installations are increasing throughout California and utilities like PG&E know that as solar costs come down, they are going to start losing more and more revenue. Since distributed generation reduces their peak load, they have less and less justification to build more generation capacity, which is the basis for their guaranteed returns. In a world where many more utility customers can afford to install solar, this is simply not a sustainable business model. So PG&E is doing what every dying industry does - attacking the "fairness" of the competitor that is eroding their bottom line. It will be up to the CPUC, the Legislature - and ultimately the solar industry - to see that the faux populism of utilities like PG&E is unmasked for what it is - naked self-interest. |

“PG&E is doing what every dying industry does - attacking the "fairness" of the competitor that is eroding their bottom line…”

Help Us Spread the News!

Help Us Reach Our Goal of 1,000 Likes on Facebook...

|

|

Thank You! |

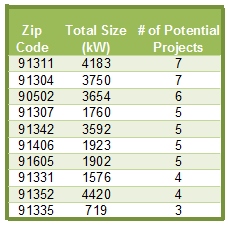

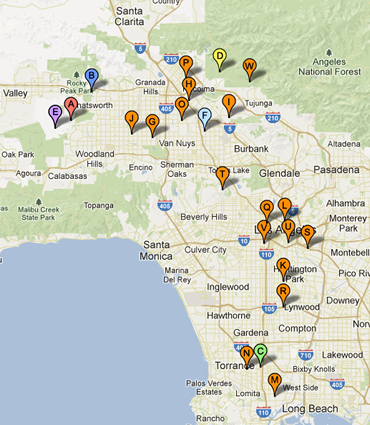

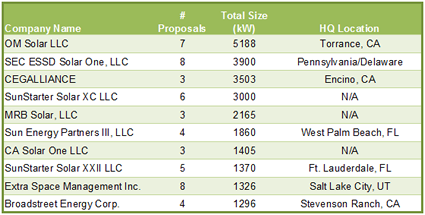

LA Feed-in Tariff Update: First Tranche is Fully SubscribedTwo weeks into the reservation period, the latest data from LADWP's Feed-in Tariff program reveals that the first 20 MW tranche has been fully subscribed. Indeed, the "large" system category (150 kW to 3 MW) was fully subscribed in the first few projects drawn from the lottery whereas the "small" category (30-150 kW) took the full two weeks to be subscribed. Here's our analysis of what we can glean so far. Owens Valley ProposalsUnder the FiT Guidelines, projects sited in the remote Owens Valley (oddly enough, part of LADWP's service area) were capped at an aggregate 4 MW. Given that land is relatively cheap out there, at least compared to real estate prices within the City proper, it was expected that only larger projects would be proposed. Moreover, the Base Price for Energy to be paid was set at 3¢/kWh less than that to be paid for all other projects to account for the transmission losses in getting Owens Valley energy to the City. Despite all of that, Owens Valley was very popular, with a total of 29 projects proposed to date totaling 65.7 MW, substantially more capacity than that designated for LA. No fewer than 18 of the proposed 29 projects were for the maximum size allowed under the program, 3 MW. (Somewhat surprisingly, there were three projects submitted at the limit of the small range in the Owens Valley. Apart from those, the smallest project proposed was 1.014 MW - which, curiously, was proposed twice.) One company dominated the proposals, Ecos Energy, LLC, with 14 projects proposed for 31.95 MW. They got lucky in the lottery, drawing the first two lottery numbers for Owens Valley projects. with a combined total of 6 MW. Los Angeles ProposalsIn the City proper, the numbers look quite different. A total of 57 projects were proposed in the large category for a total of 44.3 MW, but in contrast with the Owens Valley, only one project was proposed at the maximum possible size of 3 MW. Instead, the majority of large projects in the City were much smaller - averaging 778 kW with 500 kW being the most popular size (4 such projects proposed). In the small project category, 38 projects were proposed to reach the 4 MW limit. The average system size proposed was 106 kW; however the most common size was the maximum for the category, 150 kW which was proposed 5 times. Coming to a Zip Code Near You?Who Are Those Guys?Part of the goal of the FiT was to provide economic opportunity for local companies and local workers. However, there were no carve-outs or preferences for local companies in the FiT Guidelines. So how did the "locals" do? Let's focus on companies proposing projects in the City proper (thereby ignoring the dominant player in the Owens Valley - Minnesota-based Ecos Energy, LLC.) Eleven companies proposed two or more projects in the large category for a total of 34 out of the 57: SEC ESSD Solar One, LLC (5 proposals / 3.5 MW), Sun Energy Partners III, LLC (4 / 1.86 MW), SunStarter Solar XC LLC (4 / 2.7 MW), CA Solar One LLC (3 / 1.4 MW), SunStarter Solar XXII LLC (3 / 1.12 MW), CEGALLIANCE (3 / 3.5 MW), Fallbrook Center Solar, LLC (3 / 1 MW), MRB Solar, LLC (3 / 2.165 MW), Extra Space Management Inc. (2 / 501 kW), Century Quality Management (2 / 570 kW), and OM Solar LLC (2 / 4.5 MW). Eight companies proposed two or more projects in the small category for a total of 25 out of the 38: Extra Space Management Inc. (6 / 824 kW), OM Solar LLC (5 / 674 kW), SEC ESSD Solar One, LLC (3 / 400 kW), Broadstreet Energy Corp. (3 / 112 kW), The Ryzmn Family Trust Dated 8/20/89 (2 / 151 kW), SunStarter Solar XXII LLC (2 / 250 kW), SunStarter Solar XC LLC (2 / 300 kW), and OYA Energy Partners LLC (2 / 100 kW). Collectively, here are the top ten companies proposing projects in the City: Three of the top ten companies are LLC's whose headquarters cannot be readily identified, although one of them, SunStarter XC LLC is most likely related to SunStarter XXII LLC out of Fort Lauderdale, Florida. The other two - MRB Solar and CA Solar One come up empty in both Google searches and with the California Secretary of State's office - raising the likelihood that they are actually out-of-state corporations. Of the seven that can be identified with some confidence, three are from California but four are not. Of course, the company that is the applicant is by not necessarily the company that will be the installer so there is still a decent chance that these projects will boost local employment. But it appears that for as many as 70% of the top applicants, we have no such assurances. Lessons So FarSo what can we learn from this? Three points seem to come out of this data:

Overall, the program seems to be off to a promising start. With some minor adjustments - and assuming that the proposed projects can actually be built - LA could really have a program that could serve as a model for the rest of the nation. |

Sarah Dara Joins Run on Sun"I am honored and excited to begin my new journey with Run on Sun," added Sarah. "I am grateful to join this team in making a positive contribution to Southern California's solar future." |