Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

February, 2012

Volume: 3 Issue: 2

Think Solar is a DIY Project? Think Again!The Web is littered with sites proclaiming the benefits of solar as a Do-It-Yourself project and we have previously written about the perils of trying to do solar yourself. But the recent windstorm in Pasadena provided dramatic proof that some things in life should be left to the pros - and solar is one of them. Take this installation for example - in a lovely part of Pasadena, the previous homeowner designed and installed this system which had a number of significant problems from the get-go. Here is the view of the site from the north looking south:

The panels that are mounted on the garage go all the way to the ridge, exposing them to higher wind forces. There are enormous trees to the west and south-east that will provide significant amounts of shade. The panels on the main roof (that mostly shaded shiny spot in front of the palm tree) are even worse as they are directly facing the tree to the south. Indeed, from this view from the south, the panels on the main roof are completely invisible:

The array on the garage is pitched at 18° whereas the array on the main roof is completely flat. Both arrays feed the same inverter which had only one MPPT channel - meaning that this system was never able to function at maximum efficiency. Not a good design. Now factor in the force of once-in-a-decade winds and life takes a definite turn for the worse. The new homeowner called us to come out and assess the damage. Here's how the array on the garage appeared when we arrived: It doesn't look any better in the other direction: What happened here? This array was attached to the roof using angle-iron from the local hardware store and simple wood screws, not lag bolts, to keep that hardware in place. Here's a close-up showing this home brew attachment "system": Those simple wood screws are a poor substitute for proper lag bolts but the previous homeowner didn't even give his system a fighting chance as he ignored the rafters altogether (even though they were clearly visible) and simply screwed his gear into the plywood under the shingles. The result was as predictable as it was unfortunate: Moral of the story? The cost of adding solar professionally continues to drop, whereas the cost of doing it wrong is as steep as it ever was. It was only good luck that prevented these panels from flying into the neighbor's back yard. If the wind had come during the day when the panels were generating power (instead of the middle of the night) the possibility of arcing and fire could have made things much worse. There is a happy ending to this tale. The present homeowner received a settlement from his insurance company and was able to hire a group of true professionals - that would be us, the folks from Run on Sun - to repair their system and Make it Right! You can see how it all turned out by reading our post: Making it Right - Solar Pros vs DIY. |

“Moral of the story? The cost of adding solar professionally continues to drop, whereas the cost of doing it wrong is as steep as it ever was…”

Help Us Spread the News!

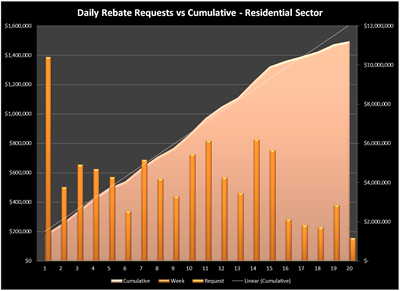

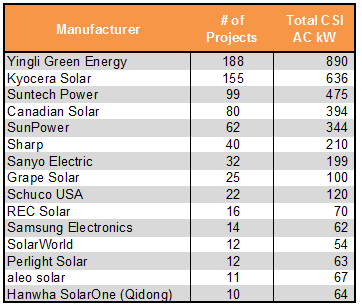

LADWP Solar Incentive Program Data UpdateBack in October, we wrote about some early trends from LADWP's restart of their Solar Incentive Program and we thought it would be worthwhile to see how things have fared in the months since. LADWP had some flaws in the dataset issued in December so we decided to wait until the next revision which came out last week. (You can access the dataset here.) As before, when reporting on project costs/Watt, we used the reported cost and the CSI AC Watts as we believe that is a more reasonable reflection of the value of the projects being proposed. Prediction UpdateIn our previous post, we predicted that the Residential rebate program would drop from Step 5 (paid at $2.20/Watt) down to Step 6 (paid at $1.62/Watt) on or about November 26, 2011. The last confirmed rebate reservation to be paid under Step 5 was #1120 and it was submitted on December 12 and confirmed on December 30. So our November 26 prediction was not too far off, and a complete application that was submitted by then should have received a Step 5 rebate. We also previously predicted that the residential sector would run out of rebate funds around April 3 of this year. How has that prediction held up? Who's Hot?A program of this size provides some interesting insights into which manufacturers have the "go-to products" in terms of number of projects and total Watts. Here is the data from the Residential sector:

The two manufacturers renowned for their high-efficiency, high-cost products - SunPower and Sanyo - came in at $7.60/Watt and $8.07/Watt respectively. No one in the industry believes that Yingli panels outperform those produced by SunPower and Sanyo. Similarly, it is interesting to see what the distribution looks like in the realm of inverters.

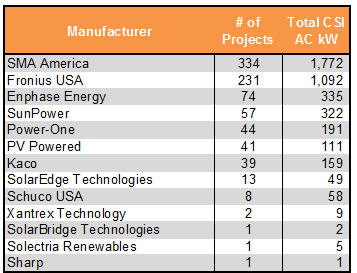

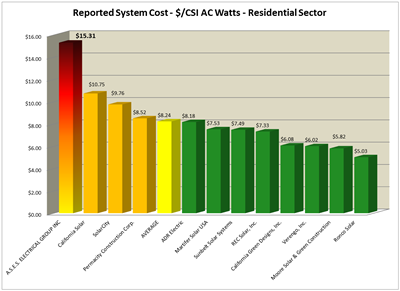

Finally, potential clients often ask about the difference in cost between a string inverter system, such as one using SMA inverters, and a microinverter system, such as one using Enphase. The average installed cost for the 334 SMA projects was $7.15/W. The average installed cost for the 74 Enphase projects was $7.32/W. That is a negligible difference and given that the two largest players in the data - SolarCity and Verengo - had none of the Enphase projects, we would expect the SMA projects to have a volume pricing advantage from those two companies alone. Bottom line: in the real world, there is very little cost difference between these two technologies. Outlier Update - A.S.E.S. Electrical - Still Out There!One of the more disturbing things that we uncovered in our previous analysis was the degree to which some companies were apparently overcharging their customers. In particular, we singled out A.S.E.S Electrical Group (aka American Solar Energy Solutions) for being particularly egregious in this regard. So, after an additional three months of data, how have things changed? Once again, we restricted the data to only residential projects where the system owner is also listed as residential - a total of 846 projects. Our previous size filter was 20kW; for this expanded data set we increased the size filter to 45kW, meaning that only companies with at least 45kW of projects in the data would be included. As a result, the chart below accounts for 560 out of the 846 projects described in the data. Sadly, our results are as disappointing as last time - check it out: Certainly caveat emptor applies when purchasing a solar power system, but at some point it seems like the utility should step in and warn its customers about predatory practices. So how about it, LADWP, isn't it time to give your customers a heads-up about what is going on? Put another way, if you are considering going solar and your installer proposes a system that is more than $8.24/Watt - and indeed, that is a very high number for installations today - we have one word of advice: RUN! |

Heather Andrews - PVAddict - RIPOn February 8, a friend of mine, and a friend of the solar industry, died.

Heather Andrews was a fierce advocate for solar power - so much so that her Twitter handle was PVAddict. That is how I met her - on Twitter and via subsequent TweetUps at solar conferences. She was a frequent commenter on our blog and on our Facebook page, but more than anything else, she simply loved the idea of installing solar and doing it the right way. Indeed, Heather was a stickler for doing it the right way - she was a proud member of IBEW and she taught classes on how to properly install solar power systems. Whenever anyone had a question about how something should be done, Heather was happy to chime in with her insights - always in a positive and supportive way. Unlike some who want to lord their knowledge over those still struggling to figure things out, Heather was happiest helping others. She exemplified the very best in our industry - smart, dedicated, and a joy to be around. She fought her illness these past few months with the same courage and tenacity that she brought to the solar industry. Sadly, this was one obstacle that she could not ultimately overcome with her love and optimism. Still, she remained positive through all of her pain and difficulties as demonstrated by one of her last tweets:

It is now up to the rest of us to carry forward her "adoration for solar" and to help fulfill the destiny in which she believed: a world powered by clean, renewable energy - installed the right way! Not surprisingly, Heather had signed up to be an organ and tissue donor and so, even in her death, she managed to seize a chance to do something positive at this time of loss. (You, too, can sign up to be an organ and tissue donor - just check out the Donate Life website.) I love you Heather and I will try my best to be true to your vision. |