Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

October, 2011

Volume: 2 Issue: 10

Why Solyndra Just Doesn't MatterFederal Subsidies for SolarMuch has been written about the so-called failure of federal solar subsidies in light of Solyndra's $535 million dollar loan guarantee debacle. Indeed, some would go so far as to demand that all solar subsidies should be abolished. To be sure, there are many reasonable voices explaining the error of such thinking, including at the NY Times, Time magazine, and the Washington Post, but the fact of the matter is that for most solar installations, loan guarantees play no role whatsoever. Here is where federal money does assist solar power installations:

Collectively, these federal tax subsidies save residential clients thousands of dollars, and as much as 50% of the total system cost for commercial clients. As a result, these subsidies play a part in every solar project installed in this country and they have gone a long way toward making solar more affordable, particularly during difficult economic times. The money is distributed to all who qualify for it without favorites - mostly - and in terms of actual dollars, it represents a tiny fraction of the $$$ lavished on other players in the energy marketplace. Taking the FifthAgainst that backdrop of how most solar projects operate in this country, the top executives at Solyndra just pleaded the Fifth Amendment in refusing to answer questions posed by a decidedly hostile House committee. That is their right - enshrined in the Constitution, no less - and it does not mean that they are guilty of any wrongdoing. (Indeed, the lawyer in me notes that it would constitute malpractice to let your client testify before such a committee while multiple investigations are in the works.) But the optics are awful. Add this sad display on top of solar's pre-existing PR problems and it is clear that, once again, the solar industry is in for some harsh words and tough times. What the Rest of Us are DoingSo what can the rest of us - who aren't taking the Fifth but are actively promoting solar for our clients because we know that it is a great deal for them - do about this? Plenty. Here are some suggestions:

Solar is an exciting and dynamic industry and as such it has had and will continue to have winners and losers. But Solyndra aside, the future for solar is bright, and for those of us at Run on Sun, there's nowhere else we would rather be - join us! |

“Solar energy is working for America now, saving us money, creating new jobs, and giving our world a brighter future...”

Help Us Spread the News!

Caltech's Solar Decathlon EntryThe Solar Decathlon is a tremendously cool event that allows collegiate teams from around the world to show just what innovative, energy-efficient design looks like - and boy can these kids think outside the box! Here in Pasadena we admit to being a bit partial to our hometown heroes over at Caltech (as in, the California Institute of Technology, in case you didn't know). Teaming up with architecture students from SCI-Arc (as in the Southern California Institute of Architecture, in case you didn't know), the combined team's entry - called CHIP, for Compact, Hyper-Insulated Prototype - features insulation on the outside of the building and some other very clever design features, including - of course - solar panels. The results are now in and our hometown team finished sixth overall, and ended up tied for the lead in two categories: Energy Balance and Hot Water efficiency. Congratulations to all who participated in this competition - you make us proud! |

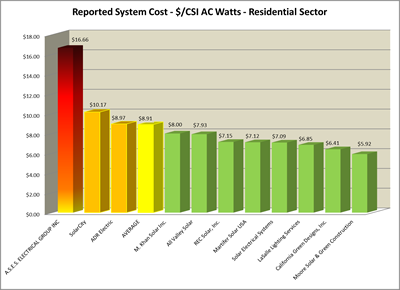

Early Trends from LADWP's SIP Restart"Data, data, data, I cannot make bricks without clay." Alone among the municipal utilities, and in a most welcome new development, LADWP has started to publish data from its Solar Incentive Program (SIP) which was restarted on September 1. Although this analysis is clearly preliminary given that there are only three weeks of data available in the 9/21/2011 working dataset, nevertheless some interesting trends are already evident and one clear necessity arises - LADWP needs cost caps even more than does CSI. BackgroundIn restarting the SIP, LADWP allocated $40 million in new funds, evenly divided between the Residential and non-Residential (Commercial, Governmental, Non-Profit) segments of the market. Although the program is technically a Step-driven program with MW allocations for each step, in reality, it is a budget-limited system - when the annual budget for a given segment is met, the program in that segment will shut down. As part of their new and improved program, DWP has also started to publish datasets that are similar to, but different from the data gathered and released by the California Solar Initiative (CSI). For example, the CSI data reports on the specific products used on the project whereas the DWP data only identifies the manufacturer. Hopefully future releases of the data will correct this limitation. In addition, neither data set allows analysts to distinguish between costs associated with the actual installation versus lease-based financing costs which apparently a handful of companies - most notably SolarCity - include in their reported costs. For the purpose of this story we analyzed DWP's most recently released dataset, dated 9/21/2011. That dataset includes data from both the so-called "legacy" program and the newly revised program. As we were only interested in the most recent trends - that is, based on what has happened since the program restarted on September 1 - we excluded all legacy data from our analysis. Also, while system costs are often reported in dollars per DC or Nameplate Watts, we don't believe that provides much insight into the quality of the systems being installed. For that reason, our system costs are based on dollars per CSI AC Watts. Outlier - A.S.E.S. Electrical Group, Inc.

|