Welcome to the

Run on Sun Monthly Newsletter

In this Issue: |

April, 2011

Volume: 2 Issue: 4

What You Need to Know About Commercial Solar Power in Three Easy Lessons (Abridged Version!)Last month we announced that we would be producing an in-depth, three-part series that would explain everything that you need to know about Commercial Solar Power in Three Easy Lessons. True to our word, that series is now out and judging from the hits that we have received on the blog, this may be our best received posts of all time. The series is too lengthy to repeat in full here, but we thought that some pithy excerpts could help "whet your whistle" for the entire series. Part 1: Understanding Your BillFirst things first - before you ever even call a solar power company - and we will explain how to find the good ones in Part 3 - you need to start with something more mundane: your electric bill. When was the last time that you really looked at your electric bill? For many business or building owners the answer is never. Oh sure, you certainly know how much you are paying - but do you know why you are paying so much? What horrors are hiding in your bills? (Caution - not for the faint of heart!) Part 2: Understanding Rebates and Tax IncentivesRebates for commercial solar power systems come in two flavors - Performance Based Incentives (PBI) and Expected Performance-Based Buydown (EPBB) - but PBI rebates are by far the more common for commercial systems above 30 kW. EPBB rebates are lump-sum payments made based on the expected performance of the system. The rebate rate is denoted in dollars per Watt based on the calculated AC Watts for the system... PBI rebates, on the other hand, are paid out over five years based on the actual performance of the solar power system as verified by monitoring devices attached to the system inverter(s). PBI rebates are denoted in cents per kilowatt hour generated... Commercial solar power systems qualify for a federal Investment Tax Credit of a full 30% on the direct cost of the system... (Disclaimer: Please consult with your tax advisor regarding the applicability of any tax incentives to your financial situation - Accountants shouldn't install solar panels, and we don't give tax advice!) Part 3: Understanding Your BidYou did it! You found three installers with great credentials who came out to your site and each one did a careful evaluation. Now you are holding in your hand a thick stack of paper from the three installers and they don’t look anything at all alike! How to make sense of all of this? |

Help Us Spread the News!

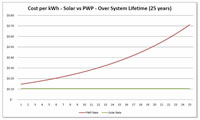

How can you best measure the value of a proposed Commercial Solar Power System?

Check out the

Cost per kWh...

Pasadena Named One of the Top-Ten Cleantech Cities in the United StatesIn a March 28th article by Shawn Lesser, Reuters published its list of the top ten cleantech cities in the U.S. Surprising no one around here, Pasadena made the list, coming in at number 9. Reuters highlighted Caltech's influence in the region, including through it partnership with the City of Pasadena in founding Entretech, a non-profit dedicated to fostering the growth of hi-tech companies in the Pasadena area. Ironically, on the solar front, Reuters identified Energy Innovations Solutions as an example of a Pasadena cleantech company, despite its relocation to Poway last summer. Nevertheless, there is plenty of solar power innovation going on here in Pasadena, and your friends at Run on Sun (somehow overlooked by Reuters!) are leading that charge. Top-ten in cleantech? Heck, yeah and just one more reason why we love Pasadena and are committed to making this one of the greenest cities in the world! If you are a Pasadena building or business owner, give us a shout and let's get you onboard with the greening of Pasadena. |