Category: "SEIA"

09/06/11

Categories: Solar Economics, Solar Tax Incentives, SEIA, SCE, Residential Solar, 2011

The State of Solar California - Outliers and Oddities - UPDATED x2!

UPDATE x2 11/8 - Solar City’s Jonathan Bass adds his perspective on our reporting about Solar City - see his response in the comments.

UPDATE 9/30 - We just heard from Jonathan Bass at SolarCity. Details at the end.

(Still no word from Galkos!)

Editor’s Note: We have now done an updated analysis showing the same data from 2012. You can read our 2012 Outliers & Oddities here.

In the first two installments in this series (Part 1 and Part 2) we looked at the most recent data from the California Solar Initiative (CSI) covering the first half of 2011 in SCE’s service area. Using that data we identified trends in cost, equipment and system efficiency. Along the way, we stumbled upon some Outliers and Oddities in the data that left us puzzled and disturbed. In this post we name names, specifically Galkos Construction (aka GCI Energy) and SolarCity.

Before we explain to you why they are featured in this post, we would remind our readers of the Solar Bill of Rights created by the Solar Energy Industry Association (SEIA) in the Fall of 2009. We wrote at some length about the Bill of Rights when it was introduced, but we want to highlight now what then we termed to be, “the most important right of all:”

8. Americans have the right, and should expect, the highest ethical treatment from the solar industry.

Beyond a shadow of a doubt, this is the most important Solar Right of all if we are to build an industry that is respected and trusted by consumers throughout this country. This should almost go without saying - and yet, saying it, and living it, is extremely important.

In our view, if we become aware of situations that don’t live up to that Right, we have an obligation to point them out so that our potential clients can make the most informed decisions possible.

In honor of that principle we present today’s post.

Outliers: Galkos Construction

In looking at the data, from time-to-time a data point would jump right off the screen. For example, examining all of the residential projects in our data - both “completed” and “pending” but excluding “delisted” - we find that the average installation cost in CSI Rating AC Watts is $8.43/Watt (in DC or nameplate Watts that average becomes $6.99). As we noted in Part 1, that number has decreased over time and also decreases as system size increases. Still, given that the residential sector (as designated in the CSI data) only consists of systems between 1 and 10 kW, you wouldn’t really expect significant price variation between installers over a six month period.

But you would be wrong.

Who Charges What?

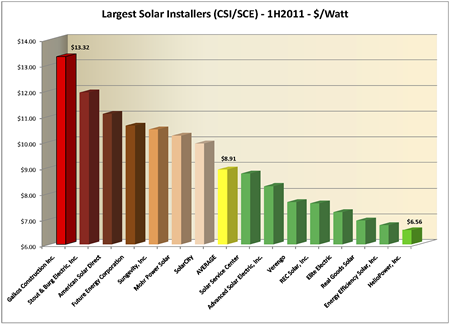

Here is a chart of the Cost per Watt for the largest installation companies in the SCE service area (you can click on the chart to see it full size):

First, let us give credit where it is due. The low end outlier is HelioPower, Inc., at $6.56/Watt, and they did it with an efficiency factor of 87% - second best of anyone on that chart. Nice.

But who is that way off in left field? Coming in at a staggering $13.32/Watt - a full $1.40 higher than their nearest competitor and more than twice what HelioPower is charging - is Galkos Construction, Inc., also known as GCI Energy, out of Huntington Beach. For that money, they must surely be offering only the most efficient and sophisticated technology, right? Not so much. To the contrary, the average installation efficiency for Galkos is only 84.9% - the second worst on the chart and well below the average of 86.11%. In fact, 99% of the time Galkos appears to use Sharp panels - not exactly an exotic solar panel brand - and in particular the Sharp ND-224UC1 panel (66.5%). A quick Google search reveals that the Sharp ND-224UC1 can be purchased, at retail, for $2.65/Watt or less. Given that Galkos handled 400 projects in this data set, it is hard to believe that their price for all of their equipment, particularly the Sharp panels, would not be heavily discounted.

Quality Counts

Quality, of course, is important, and the data does not reveal - though the Internet hints at - the quality of installations from Galkos. Here is how the company describes its own product offerings (from the “Services” page of their website):

Solar by GCI [Galkos Construction, Inc.] Energy

GCI Energy is the largest solar company in Southern California with over 30,000 customers. So you get the most knowledgeable professionals, excellent customer service and a better price.GCI Energy solar offers the highest efficiency solar panels on the market - those manufactured by Sharp. With Sharp Solar Panels, GCI Energy can tailor a solar panel installation to your specific needs and lifestyle, so you get maximum performance without a maximum investment.

(Emphasis added.)

Does Galkos actually have 30,000 solar customers? Certainly not (nobody does). Are they providing “a better price"? It is not clear what their standard of comparison might be - but their price is not better than any of their major competitors in that chart. And of course, the statement does not define what they mean by “the highest efficiency solar panels on the market,” but it seems unlikely that Sharp would make that claim. Here’s one chart that concludes that they couldn’t (note the efficiency of the SunPower and Sanyo panels first, then search for Sharp).

All we can say in response is, caveat emptor.

Oddities - SolarCity

Now we turn to the Oddities section of this post. Unlike the outliers, which were always of interest to us, we were not looking for the oddity we report here - it literally just jumped out at us.

Sold versus Leased

Question: What is the difference in reported cost between systems sold directly to the end customer and those that are leased (i.e., have a third-party owner in CSI parlance)?

The initial difference that we stumbled upon was so startling that we knew we needed to narrow our focus and control for as many variables as possible to isolate that one factor. To achieve that end we restricted the data to those residential systems (i.e., between 1 and 10 kW) that were “pending” in the CSI/SCE data (thus, the newest proposed systems in the data which, based on our Part 1 analysis should mean the lowest cost systems). That way our project sample would be as homogenous as possible, eliminating cost variations based on system size and timing.

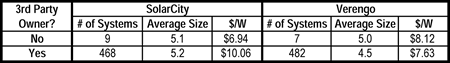

Given those restrictions, the top 5 installation companies in which the system is owned by a third party are: Verengo (482 systems), SolarCity (468), American Solar Direct (124), Sungevity (99), and HelioPower (63). Of those five, only two also have direct sales projects pending: Verengo (7) and SolarCity (9). Let’s see how they compare:

What is going on here? For Verengo, as the number of systems increases - which it does in going from sold systems to leased systems - their cost per Watt decreases - which is what we would expect. But not so for SolarCity - even though they are leasing 50 times as many systems as they are selling, their cost for the leased systems went up - way up - as in up by $3.12/Watt!

(One possible explanation for this discrepancy would be that SolarCity uses much more expensive equipment in their leased systems than they do in the ones that are sold. But they don’t. On their sold systems, SolarCity always selected a Fronius inverter and their panel choices were split among Yingli (56%), Kyocera (33%) and Sharp (11%). On their leased systems, SolarCity selected Fronius inverters 98% of the time and again split their panel choices among Yingli (68%), Kyocera (28%), and BP (3%) with the remaining 1% scattered among Suntech, Sharp and Sanyo. In other words, there is no significant difference in SolarCity’s equipment choices between sold and leased systems.)

Why Does this Matter?

Why does this significant cost differential matter, you might ask? After all, customers aren’t paying that price - they are paying on a lease so the “cost” of the system doesn’t matter to them, all they care about are their lease payments. True enough - unlike the case with our Outlier above, the end customer is not the victim here.

Recall, however, that for systems that are leased, the third-party owner - presumably SolarCity and its investors in this case - receives both the rebates and the tax benefits associated with the installation. While the rebates are independent of the system cost (they are paid based on CSI Watts), not so for the tax benefits. Commercial operators (even though these are residential installations they are treated as commercial projects for tax purposes) are entitled to both a 30% tax credit as well as accelerated depreciation based on the cost of the system.

For the 468 systems that SolarCity is leasing, their total cost is $24,261,735 to install 2,412 kW. If those installations were billed out at the $6.94/Watt they are charging for their sold systems, the installed cost would be $16,739,280 - a difference of $7,524,037. At 30% for the federal tax credit, taxpayers are giving SolarCity an extra $2,257,211 - just from six months worth of installs in only the SCE service area.

Wow!

In the words of the 70’s pop song, How long has this been going on?

How Long Indeed

We decided to find out.

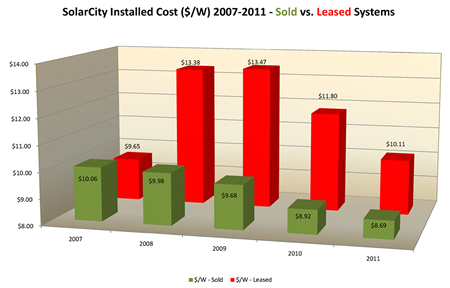

Although all of our analyses up until now in this series have been restricted to the first half of 2011, the actual data set contains entries from the inception of the CSI program. Thus we can look at all of SolarCity’s installs going back to 2007 and compare them as we did for the 1H2011 pending installs above. We will use the First Completed date to group these by year and analyze only “installed” - and not “pending” applications. Here’s the data:

The answer would appear to be, almost from the beginning! Back in 2007, Solar city sold ten times as many systems as it leased. By 2008 the ratio was down to 4-1 and ever since then leasing has been SolarCity’s predominant business strategy with the ratio of leased to sold now standing at nearly 16-1 in 2011.

Bottom Line

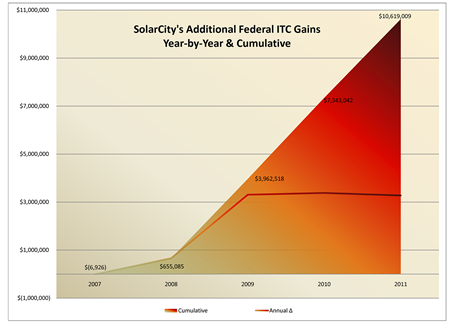

What, then, is the cumulative impact to SolarCity’s bottom line from this trend throughout California? We aren’t in a position to calculate the depreciation benefits (since that is a function of the system owner’s tax bracket) but we can readily calculate the added value derived from the 30% federal tax credit due to this increased cost per Watt.

Here is our plot of the cumulative effect of those year-by-year increases:

After a slow start in 2007-08, SolarCity’s “model” really took off and has garnered the company an extra $3,000,000+ each year since 2009 (and, of course, 2011 is not yet over) for a total excess accumulation of $10,619,000. Depending on the investors’ tax bracket, the depreciation could be worth nearly as much as the tax credit.

Double Wow!

UPDATE 9/30 - We have now heard from SolarCity

We just heard from Jonathan Bass, Director of Communications at SolarCity who took exception with our report, although he did concede that he could see how we could have reached the conclusions we published in light of the CSI data. We encouraged him to please send us a written response in as much detail as he chose and we would publish it in its entirety. While he agreed that SolarCity would be publishing its response, he did not commit to publishing the information here.

In any event, when we hear more we will update this post again.

What’s Next?

No doubt there is more that we could do with these revelations - but wouldn’t it be better for those with actual oversight obligations to examine this data as closely as we have and to take appropriate action?

As always, we welcome your comments - and if we hear from any of the folks named in this series we will be sure to update the appropriate post.

11/22/09

Solar Bill of Rights - # 8 - The Most Important Right of All

Keeping the best and most important Right for last, SEIA’s Solar Bill of Rights concludes with Right # 8:

8. Americans have the right, and should expect, the highest ethical treatment from the solar industry.

Beyond a shadow of a doubt, this is the most important Solar Right of all if we are to build an industry that is respected and trusted by consumers throughout this country. This should almost go without saying - and yet, saying it, and living it, is extremely important.

As we have seen time and again, there are many solar installers out there who care way more about making a sale than they do about building a reliable system that will meet the customer’s needs for the next 25 years. (As you can see here.)

But what does ethical treatment really mean? We think there are some very important elements that together constitute this Right, including:

- Systems should be sold to meet the consumer’s needs - not the installer’s revenue requirements.

- Not all sites are appropriate for solar and installers must tell consumers when their site is just not right.

- Sometimes that means turning down an available job because the installer knows it will never perform properly.

- Solar power systems, while technical, are not rocket science and consumers are entitled to have all of their questions answered.

- Solar power systems should be installed by qualified electricians - not plumbers, roofers or the handyman down-the- block.

- Installations should make the site look better; solar should not be an eyesore.

- Installations should work better than advertised.

- Installations should be safe and reliable for their entire projected lifetime - none of what you see here.

- Rebate processing is complicated and confusing; installers should bear that burden, not consumers.

- In all of our dealings with consumers, utilities and inspectors, installers must be scrupulously honest.

These are reasonable requests for consumers (and America in general) to make of the solar industry. As professionals in a rapidly expanding field, we need to hold ourselves to the highest standards, and hold others in our field accountable when they do not measure up. Otherwise, all of us will be diminished by the acts of the fly-by-night artists and scammers – and the entire nation will suffer.

11/15/09

Categories: All About Solar Power, SEIA, Solar News

Solar Bill of Rights - Right # 7

The last two of the eight Rights in the Solar Bill of Rights once again focus on the rights of consumers. Here is number Seven:

7. Americans have the right to buy solar electricity from their utility.

As utilities operate under Renewable Portfolio Standards they are required to purchase increasing amounts of renewable energy. Utility customers should be allowed to purchase the renewable energy of their choosing, thereby voting with their dollars for the energy source that they prefer.

Some utilities, such as Pasadena Water & Power, have a “Green Energy” option that allows customers to purchase some or all of their electricity from renewables, but it does not allow them to choose solar specifically (and right now that appears to be all wind power). By allowing consumers a choice, utilities would receive a premium for providing solar energy which can then be used to fund incentives for adding solar, thereby increasing the supply. It would also let consumers proclaim their desire to avoid using coal-fired electricity.

11/10/09

Categories: All About Solar Power, Solar Economics, SEIA

Solar Bill of Rights - Rights # 4, 5 & 6

The next Rights set forth in SEIA’s Solar Bill of Rights, concern those rights specific to the solar industry itself.

In particular:

4. The solar industry has the right to a fair competitive environment.

5. The solar industry has the right to equal access to public lands.

6. The solar industry has the right to interconnect and build new transmission lines.

Let’s take these one at a time…

What does it mean for the solar industry to have a “fair competitive environment” in which to operate? After all, isn’t solar already heavily subsidized through rebates and tax credits? It is true that over the past few years, particularly in California, we have seen more favorable treatment for solar than in the past. And yet, these subsidies are but a tiny fraction of the billions of dollars that the fossil fuel industries have received for decades.

According to Scientific American (citing a study by the Environmental Law Institute and the Woodrow Wilson International Center for Scholars), between 2002 and 2008, the fossil fuel industry received approximately $72 billion. In contrast, all renewables received just $29 billion, but more than half of that - $16.8 billion - went to pay for ethanol from corn, a poor environmental choice. Solar’s share? Less than $1 billion.

A similar concern arises over access to public lands. For years, fossil fuel producers have had nearly unfettered access to federal lands with the government getting a very poor return on its investment. (For example, see this listing of Bush-era actions to open up public lands to the fossil fuel industry.) For utility scale solar to succeed, access to public lands in an environmentally sensitive way is crucial.

Likewise, to get clean solar energy to the demand centers around the country that need it, the solar industry and others will need to construct, and interconnect into, new, smarter transmission systems. These too will need access to public lands to make them affordable.

These rights will go a long way to leveling the playing field for the solar industry and hasten the day when a substantial percentage of the nation’s energy can be supplied by clean solar power systems.

11/06/09

Solar Bill of Rights - Rights # 2 & 3

Continuing our series on the recently promulgated Solar Bill of Rights, here are some thoughts on Rights 2 & 3. Here they are:

2. Americans have the right to connect their solar energy system to the grid with uniform national standards.

3. Americans have the right to Net Meter and be compensated at the very least with full retail electricity rates.

The good news is that at least here in California, #2 has already been secured. All of the utilities in our service area (the greater Los Angeles region) allow grid-tied systems to be connected to the grid with a minimum amount of hassle and red-tape.

The news is not quite so good for Right #3. Under existing California law, there is a cap on the number of net metering agreements that utilities are obligated to offer - presently at 2.5% of the utilities peak load. Such a cap makes no sense, and could work to seriously limit the growth of solar in California. Fortunately, there is legislation in the works, authored by Assembly Member Nancy Skinner (D-AD14) that would raise the cap to 5%. Skinner’s bill, AB560, will be reintroduced next year.

Finally, we made real progress on the fair compensation portion of Right #3 with the signing into law of AB920. For the first time, solar customers in California will no longer be “donating” their surplus energy to their utility. Instead, utilities must pay solar customers who are net energy producers using the same rate structure by which that customer would normally be billed.

What do you think about these rights? Please add your comments, below.