Category: "PWP Rebates"

05/04/12

Categories: PWP Rebates, PWP, Commercial Solar, Non-profit solar, Westridge PAC Project

Installing Solar at Westridge - Part 1

In November of 2011, Run on Sun was hired by Westridge School for Girls to install a 54 kW solar system on the roof of the school’s Fran Norris Scoble Performing Arts Center (the “PAC” as it is known on campus), and that project was just recently completed. This multi-part series will document the process by which we went from a signed contract to a signed-off solar power system. Not surprisingly, there were a few twists and turns along the way that had to be resolved before we could deliver a successful project, and this series will showcase those developments in the following five parts:

Part 1 - The Rebate Application (this post)

Part 2 - The Permit Process

Part 3 - On the Ground

Part 4 - On the Roof

Part 5 - Putting it All Together

The Rebate Application

The rebates being offered from Pasadena Water & Power (PWP) for this non-profit project were scheduled to step-down on December 1, 2011. Indeed, this was a substantial rebate reduction - 26% - such that failure to secure the existing rebate rates would have amounted to a hit of tens of thousands of dollars for our client. And PWP had made it very clear - unless applications were 100% complete and correct, they would be rejected and when resubmitted would be subject to the reduced rebate rates. Clearly the pressure was on to get this right the first time!

The application package consisted of eight parts - most of which were straight-forward, but a couple required substantial work to guarantee that the application as submitted would be acceptable the first time. Here are the parts that went into the rebate application: 1) Signed Rebate Application (PWP’s form, signed by client and Run on Sun under penalty of perjury!); 2) Single Line Diagram for the electrical components of the system (more on this below); 3) Site Plan; 4) CSI Report (as produced by the California Solar Initiative’s rebate calculator); 5) Shading Analysis (i.e., a Solar Pathfinder report to support the shading values used to create the CSI Report); 6) PWP’s Net Metering Agreement (executed by the client); PWP’s Net Metering Surplus Compensation form (for AB 920 compliance); and 8) Installation Contract between the client and Run on Sun. Also, since this was a non-profit client, proof of non-profit status was also required.

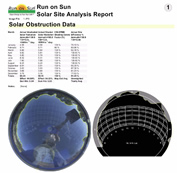

Shading Analysis & CSI Report

PWP wisely requires the submission of a shading analysis in addition to the output from the CSI rebate calculator. Since the amount of shading at the site directly impacts the performance of the system - and hence the CSI AC Watts of the system (or the predicted annual energy output in the case of a PBI rebate) - it really doesn’t make sense for a utility to simply trust that the installer is telling the truth about shading.

PWP wisely requires the submission of a shading analysis in addition to the output from the CSI rebate calculator. Since the amount of shading at the site directly impacts the performance of the system - and hence the CSI AC Watts of the system (or the predicted annual energy output in the case of a PBI rebate) - it really doesn’t make sense for a utility to simply trust that the installer is telling the truth about shading.

The output from the Solar Pathfinder proves that the shading numbers claimed are the shading values present at the site.

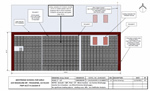

Site Plan

The site plan needed for the rebate application is a much simpler plan than what will ultimately be required for the permit, really only requiring an indication of where the various components of the system will be relative to the overall site. However, our system occupies three different areas of the PAC: the roof where the array itself is located, a ground-level storage area where our step-up transformer will be, and the utility switchgear, located on the far north end of the building. Thus our site plan included drawings for each location.

The array drawing showed the three sub-arrays and the clear space allocated for fire department access. Each sub-array consisted of three branch circuits, each of which was “center-tapped” to reduce the voltage drop in the associated branch circuits. Each branch circuit landed at a sub-array service panel which then fed a master “solar-only” sub-panel in the transformer area.

The array drawing showed the three sub-arrays and the clear space allocated for fire department access. Each sub-array consisted of three branch circuits, each of which was “center-tapped” to reduce the voltage drop in the associated branch circuits. Each branch circuit landed at a sub-array service panel which then fed a master “solar-only” sub-panel in the transformer area.

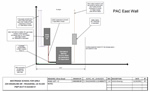

The transformer area drawing detailed the conduits coming down off the roof (one each from each sub-array sub-panel), the master sub-panel which feeds our step-up transformer (to change the 208 VAC three-phase power coming from the roof to 480 VAC three-phase supplied by the utility service) and then a safety disconnect switch located adjacent to the transformer. From the safety switch a fourth conduit carries the required conductors back across the roof to our service switchgear area.

The transformer area drawing detailed the conduits coming down off the roof (one each from each sub-array sub-panel), the master sub-panel which feeds our step-up transformer (to change the 208 VAC three-phase power coming from the roof to 480 VAC three-phase supplied by the utility service) and then a safety disconnect switch located adjacent to the transformer. From the safety switch a fourth conduit carries the required conductors back across the roof to our service switchgear area.

The service panel area drawing showed the placement of our lockable PV AC Disconnect, the associated performance meter, and our circuit breaker for the system located in the existing service switchgear.

The service panel area drawing showed the placement of our lockable PV AC Disconnect, the associated performance meter, and our circuit breaker for the system located in the existing service switchgear.

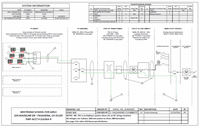

Single Line Diagram

Our most significant deliverable in the rebate application packet was the single line diagram (SLD) for the electrical circuits. Since this diagram shows how all of the electrical components of the power generating system interconnect - including the tie into the utility’s grid - we knew that this would be the most closely scrutinized piece of the submission. To be sure, PWP has a generic SLD that installers can use (in fact, we helped develop it!) but that drawing does not cover the use of Enphase Micro-inverters which we were featuring on this job, nor does it allow for a step-up transformer.

Fortunately, we had developed a very flexible SLD format from prior jobs that we could readily adapt for this project. However, before we submitted it to PWP, we forwarded it to the application engineers at Enphase Energy to make sure that they were comfortable with what we had designed. Enphase was more than accomodating - given our tight time frame they bumped us to the front of their engineering review queue and came back promplty with the good news - the design was good as we had drawn it and no revisions were needed. Of course, that was no guarantee that the utility would agree, but it is always nice to have a P.E. on your side!

Fortunately, we had developed a very flexible SLD format from prior jobs that we could readily adapt for this project. However, before we submitted it to PWP, we forwarded it to the application engineers at Enphase Energy to make sure that they were comfortable with what we had designed. Enphase was more than accomodating - given our tight time frame they bumped us to the front of their engineering review queue and came back promplty with the good news - the design was good as we had drawn it and no revisions were needed. Of course, that was no guarantee that the utility would agree, but it is always nice to have a P.E. on your side!

Included in the SLD preparation was a complete set of voltage drop calculations. This was complicated by the fact that we had 9 different branch circuits, three different sub-panels and two different operating voltages! Good design calls for limiting total voltage drop to less than 3%. To keep our worst case scenario within that limitation (covering the branch circuit farthest from the main “solar-only” sub-panel) we ended up with 4 different gauge sizes of conductors at different legs of the run: #12 in the branch circuit cables (supplied by Enphase), #8 from branch circuit jbox to sub-array sub-panel, #2 from sub-panel to main “solar-only” sub-panel, #3/0 from that sub-panel to the transformer and then #2 from the transformer back to the service equipment area. (One change that occurred during the install process increased the length of some of these runs - and that necessitated some wire size changes to insure that we stayed comfortably below our 3% limit. Those will be discussed in future episodes.)

One Big Present

All of those documents, plus pages and pages of cut sheets describing all of the key products being used, were then submitted to PWP - one day before the deadline! With no margin for error, our submission had to be perfect. Thankfully, it was - PWP gave us their official blessing to proceed three weeks later, just three days before Christmas. One big present, indeed.

Our first hurdle successfully surmounted, it was time to prepare for the most nerve wracking part of the process - pulling the permits! That’s the subject of our next installment - stay tuned!

12/06/11

Categories: All About Solar Power, PWP Rebates, PWP, Non-profit solar, Westridge PAC Project

Westridge Chooses Run on Sun for 54kW Solar Project

We are very pleased to report that one of the premier schools in Pasadena - or pretty much anywhere for that matter - the Westridge School for Girls has just selected Run on Sun to design and install a 54 kW solar power system on the Fran Norris Scoble Performing Arts Center.

It is very gratifying to have been chosen over some tough competition for this project, particularly given the School’s well-established commitment to sustainability. Indeed, just last year Westridge dedicated a new science building which has received the coveted, but very rare, LEED Platinum designation. Now as part of Westridge’s plan to “green” all of the campus, the 54 kW solar power system will be another dramatic step in that direction.

Even better, since the project will use Enphase micro-inverters, the students from grades 4-12 will be able to study the performance of the system right down to the individual panel level. We look forward to working with the Westridge faculty and administration as they teach their students about the difference that solar power can make in their lives.

At Run on Sun we have a special place in our hearts for working with non-profits and we would love to help your non-profit add solar too!

04/28/11

Categories: All About Solar Power, Solar Economics, PWP Rebates, PWP, Energy Efficiency

Run on Sun Featured in Pasadena Weekly Article - The City of the Future

The April 28, 2011 edition of the Pasadena Weekly has a very nice article by Sara Cardine titled, The City of the Future, which includes an interview with Run on Sun Founder & CEO, Jim Jenal.

Part of its month-long series of articles on going Green, Cardine’s piece looks specifically at how Pasadena has taken long strides toward turning itself into a truly Green City. Starting with its adoption of a “Green Action Plan” in 2006 - the same year that Run on Sun was founded - Pasadena is working hard to turn its good intentions into practical actions. For example, Pasadena has made major reductions in its own energy usage and is pushing to do much more.

From the article:

Since the Green Action Plan was established, the city has seen improvements on multiple levels, said Ursula Schmidt, the city’s sustainability affairs manager. In addition to increased water and energy conservation, renewable energy use and recycling, the city is also making headway in its green building program and in an effort to establish an alternative-fuel fleet.

Last year alone, Pasadena trimmed its peak power demand by 4.45 megawatts and saved enough energy to power 3,640 homes for one year. Officials now hope to see a citywide reduction in greenhouse gas emissions of 25 percent by 2030, along with an increase in the citywide use of green energy sources beyond recently adopted statewide standards. Last month, state lawmakers passed SBX1 2, a law requiring that 33 percent of the state’s energy come from renewable sources by 2020. Pasadena is already pushing itself past that benchmark; last year the City Council adopted a comprehensive integrated resources plan that set a goal of 40 percent renewable energy use by 2020, according to Gurcharan Bawa, PWP assistant general manager.

Encouraging commercial and residential customers to Go Solar is a big part of the strategy to meet those goals. Caltech, one of the largest energy users in the City, has installed over 1.3 megawatts of solar power on its campus with more planned. Yet some customers have been reluctant to follow Caltech’s lead. To get the installer’s view, Cardine interviewed Jim Jenal and quoted him as he described the process of working with an installer to get a proposal and ultimately, an installed system.

Please check out the article online or pick up a print copy (which features a wonderful picture of Jim with that famous Solar Kid) and let us know what you think.

As Cardine concluded:

“This isn’t rocket science — it’s truly something normal, everyday people can understand and feel comfortable with,” Jenal said.

It just begins with a little knowledge and the commitment to make a difference.

We couldn’t agree more!

03/04/11

Categories: All About Solar Power, Solar Economics, Solar Rebates, Solar Tax Incentives, PWP Rebates, SCE/CSI Rebates, BWP Rebates, GWP Rebates, LADWP Rebates, PWP, SCE, LADWP, BWP, GWP

What You Need to Know About Commercial Solar Power in Three Easy Lessons - Part 2: Understanding Rebates and Tax Incentives

(Editor’s Note: Part 1 of this series - Understanding Your Bill can be found here.)

Commercial solar power systems are economical now - and in the first part of our series we explained how understanding your bill is the key to understanding what is currently driving your costs and how much you will be able to save.

Now we turn to the next step in preparing to install a commercial solar power system - understanding the applicable rebates and tax incentives. We have written at great length before about these topics, including a blog post summarizing the year-end state of all solar power rebates in the Run on Sun service area and our solar tax incentives page provides great detail into this topic for all types of system owners - commercial, residential and non-profit. In this post we will analyze just those rebates and incentives that are applicable to commercial solar power installations.

PBI vs EPBB Rebates for Commercial Solar Power Systems

Rebates for commercial solar power systems come in two flavors - Performance Based Incentives (PBI) and Expected Performance-Based Buydown (EPBB) - but PBI rebates are by far the more common for commercial systems above 30 kW. EPBB rebates are lump-sum payments made based on the expected performance of the system. The rebate rate is denoted in dollars per Watt based on the calculated AC Watts for the system. EPBB rebates are nice for the consumer as the money is paid as soon as the system is approved, but for larger systems, they represent too much upfront risk for the utility. Since there is usually no requirement to monitor the performance of the system, the utility ends up putting out its money with little guarantee of reaping the expected benefit.

PBI rebates, on the other hand, are paid out over five years based on the actual performance of the solar power system as verified by monitoring devices attached to the system inverter(s). PBI rebates are denoted in cents per kilowatt hour generated. Since the utility only pays for power actually provided, rebate dollars are guaranteed of providing the bargained for benefit. However, because of the need to provide the utility with verified performance data, PBI rebates increase the Operations & Maintenance expense of a commercial solar power system - at least for the five years of the rebate. On the other hand, if your system is well maintained and conservatively designed, you may actually receive more in rebate payments than originally projected.

Each utility will have a threshold system size beyond which the system owner must take a PBI rebate.

Regional Rebate Amounts for Commercial Solar Power Systems

Of late there has been a great deal of turmoil among the local municipal utilities regarding their rebates. This has lead to uncertainty and delays. As of this writing, here is the landscape for commercial solar rebates in the Run on Sun service area:

| Utility | PBI Rate | EPBB Rate | PBI/EPBB Threshold |

| SCE | 3¢/kWh | $0.25/W | 50 kW |

| PWP | 21.2¢/kWh | $1.40/W | 30 kW |

| BWP | Suspended until August 2013 | $2.07/W | 30 kW |

| GWP | Suspended until 2015 | ??? | ??? |

| LADWP | Suspended until July 2011 | ??? | ??? |

This means that as of this writing, only SCE and PWP are paying rebates on commercial solar power systems greater than 30 kW. While LADWP is expected to come back online this summer, in what form remains to be seen.

We believe that these suspensions have come about because the lobby for commercial solar rebates is small and too often silent. Of course, when no public discussion occurs before the decision is made to suspend rebates - as happened in both Glendale and Burbank - it is pretty hard to organize solar supporters. Indeed, in Los Angeles, where the plans to severely limit solar rebates were publicly debated, the solar community came out in numbers to argue for those rebates - which resulted in LADWP only suspending their program for a comparatively short time.

The conclusion in inescapable - until there is a statewide feed-in tariff at a reasonable rate that offers predictability along with economic viability, the market for commercial solar in this state will continue to be subject to the caprice of unaccountable bureaucrats.

Tax Incentives for Commercial Solar Power Systems

While the news regarding rebates remains murky, the news on the tax front is - at least for this year - very good.

One caveat before we begin - while we believe this information to be accurate as of the date that it is written, you must always consult with your tax professional as to the applicability of these incentives to your tax situation. Accountants shouldn’t design solar power systems and we don’t give tax advice.

Commercial solar power systems qualify for a federal Investment Tax Credit of a full 30% on the direct cost of the system. (By “direct cost” we mean those costs directly associated with installing the solar power system. The applicability of the Credit to indirect costs - such as deciding to re-roof your building before adding solar - must be decided on a case-by-case basis - see why that tax pro gets paid the big bucks?) That Credit can be taken over two years and is a substantial incentive if you have the tax liability to offset. Fortunately for systems that are put in service in 2011, commercial solar power system owners can elect to receive a Grant directly from the Treasury for the full 30%, regardless of their tax appetite. Moreover, that Grant is paid out typically within 60 days of project completion, as opposed to being credited in the next tax payment cycle. This provision in the tax code is subject to expiration at the end of this year, and there is no telling whether a more conservative Congress will renew it. (The tax Credit, however, continues through 2016.)

Commercial solar power systems also qualify for accelerated depreciation. For the past several years, that was a five year period with 50% in Year 1 and the remaining 50% divided evenly over the next four years. (California offers a similar depreciation schedule.) However, once again 2011 is special. This year alone, that depreciation is 100% in Year 1, meaning that system owners may realize more of their savings sooner.

Collectively, rebates and tax incentives can reduce the cost of a commercial solar power system by 50% or more. When combined with the savings from the energy generated, it is easy to see why a commercial solar power system is one of the best investments a building or business owner can make.

Up Next - Part 3 of Our Series: Understanding Your Bid for a Commercial Solar Power System