Category: "Commercial Solar"

08/02/13

Categories: Solar Economics, Commercial Solar, Residential Solar, Ranting, 2013

State of SoCal Solar 2013 - Part 1: Methodology & Trends

Today is our first of three posts looking at the state of solar in Southern California for the first half of 2013 as revealed by the data compiled for the California Solar Initiative (CSI). This first post explains our methodology and highlights some interesting trends in the data.

Methodology

Let’s start with our methodology. The CSI collects a significant amount of data as part of managing its rebate program and most, though not all, of that data is made available to the public. For example, while CSI collects data from installers that identify four components of system cost - solar modules, inverters, permitting and everything else - the data that is made available rolls all of that up into just one number - Total Cost. Nevertheless, the CSI data is the most comprehensive data set available and covers all projects being built in the service areas of California’s three investor-owned utilities: PG&E, SCE and SDG&E.

For our analysis, we started with the CSI Working Data set from July 31, 2013. (Here’s a link to the CSI Working Data download page and here’s a link to the data set (11 MB zip file) that we used for this analysis.) This analysis just looks at data from the SCE service area and to limit our time period to just the first half of this year, we added a Status Date field to the data which is the latest of a series of milestone dates recorded in the data (from First Reservation Date to First Completed Date). We then extracted our data for dates from 1/1/2013 to 6/30/2013. After that it is a matter of pivot table magic!

One other note - there are multiple ways to identify the size of a project from the data: Nameplate Rating (i.e., DC Watts), CEC PTC Rating (which accounts for the PTC rating of the solar modules used times the efficiency of the inverters chosen) and CSI Rating (which applies the Design Factor to the CEC PTC Rating and which is the basis for rebate payments. For the most part, unless otherwise noted, we will be using CEC PTC Rating for system size since that accounts for some measure of equipment quality but isn’t confounded by site complications such as shading or the use of tracking systems. In particular, our $/W figures are computed this way.

Trends

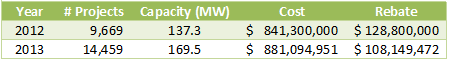

Overall, our data set reflects 14,459 projects, up from 9,669 over the same period last year - an increase of 49.5%.

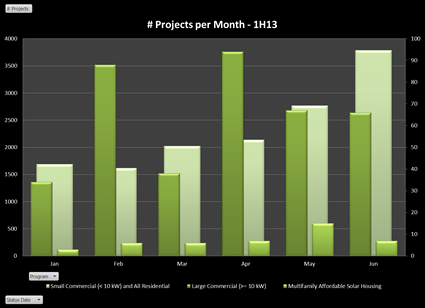

There are three program divisions in the data: Residential (projects under 10kW), Commercial (projects greater than or equal to 10 kW) and the Multifamily Affordable Solar Housing (MASH). The overwhelming majority of these projects are in the Residential program: 14,028 (97% of the total) are Residential, followed by 387 (2.7%) Commercial and just 44 MASH projects. However, MASH projects are generally associated with affordable housing developments and so they can be quite large overall. In fact, the average MASH project is 158.7 kW, compared to just 5.6 kW for Residential and 216.3 kW for Commercial. Altogether, Commercial projects account for 83.7 MW, followed by 78.8 MW in the Residential program with just 7.0 MW in the MASH program.

Compared to last year, which saw a decline in the amount of solar capacity in the data, capacity this year is up 59% over last year:

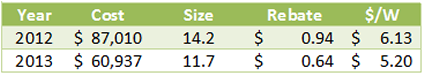

At the same time, the average system size continues to decline from 14.2 kW in 2012 to just 11.7 kW this year. Likewise, rebates are falling (by 32%) but so are overall prices (15.2%), just not as fast.

Still, in raw dollars, the reduction in system price of $0.97/W from a year ago, nearly triples the decline in rebate rate.

We will have lots more to say about system costs in subsequent posts.

The pace of projects is accelerating, driven by dramatic growth in the Residential program (as always, click on the chart to see it full size):

(To make the Commercial and MASH projects visible we have put them on a second axis.) Residential projects have grown from less than 1,700 in January to nearly 3,800 in June!

(To make the Commercial and MASH projects visible we have put them on a second axis.) Residential projects have grown from less than 1,700 in January to nearly 3,800 in June!

MASH-Up

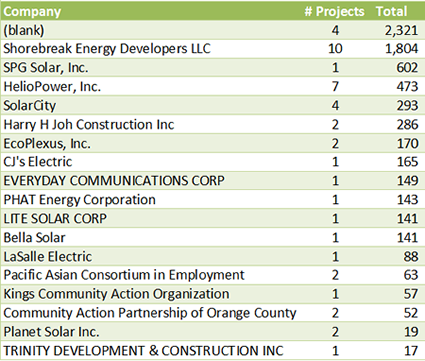

Since it is a relatively small slice of the pie we are going to generally ignore the MASH program but before we leave it aside, we thought we should at least take a peak at who are the players in this program. Here’s what we found:

Four projects have no solar contractor associated with them in the data (curious). The big winner, however, is Shorebreak Energy Developers - not a company on our radar, but obviously a major player with nearly 2 MW worth of projects in the program. A few familiar names - HelioPower, SolarCity and even our friends down the road at PHAT Energy (well done, Philippe!).

Roughly half of these projects are third-party owned: 24 of the 44 for a total of 3.5 MW out of a total 6.98 MW. The average cost per CEC PTC Watt is also almost identical, $5.52 for third-party owned versus $5.55 for sold systems. Yet within that average was a very significant range from a high of $13.12 for the 141 kW project being built by Lite Solar, all the way down to $4.32 for the 601 kW project being built by SPG Solar. Shorebreak, the leader in the amount being installed and total number of projects is also a leader on price, coming in at $4.90.

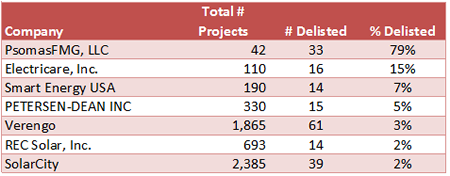

Making the Delist

One stat we continue to find intriguing is the number of delisted projects - projects that got entered into the data but then cancelled at some point. Altogether, there are 471 projects delisted, or just 3.26% of the total, down from 4.2% last year. Those delisted projects accounted for 16.8 MW of capacity or 9.9%, which is up significantly from last year. In other words, fewer projects were delisted, but they accounted for a bigger piece of the potential installed capacity. The majority of the delisted projects, 324 of them (68.8%) were third-party owned.

149 different companies made their way onto the Delist - not surprising for very large players, but as before we decided to look at these companies as a share of their overall project total. We limited to companies with at least 10 delisted projects and then rank ordered them by the percentage of their projects that are delisted. Here they are:

What is up with this? PsomasFMG has 79% of its total projects delisted? Turns out their 33 delisted projects account for nearly half the the total delisted projects by capacity. Not surprisingly, these are all third-party owned Commercial projects ranging in size from 61 kW to just under 1 MW.

What is up with this? PsomasFMG has 79% of its total projects delisted? Turns out their 33 delisted projects account for nearly half the the total delisted projects by capacity. Not surprisingly, these are all third-party owned Commercial projects ranging in size from 61 kW to just under 1 MW.

The other big winners, Electricare, Smart Energy, and Petersen-Dean had all of their delisted projects in the Residential program with sizes ranging from under 3 kW to just under 10 kW. Interestingly, of the worst actors last year: Remodel USA, Herca Solar and A1 Solar Power, both A1 Solar (4 projects) and Remodel USA (1) still made the delist this go around, but with greatly improved numbers. (Herca Solar has 44 projects overall in the data, none delisted.)

While Commercial projects are necessarily more complex, making cancellations more likely, it is hard to understand a 15% delist rate for Residential projects. Caveat emptor.

Does Size Matter?

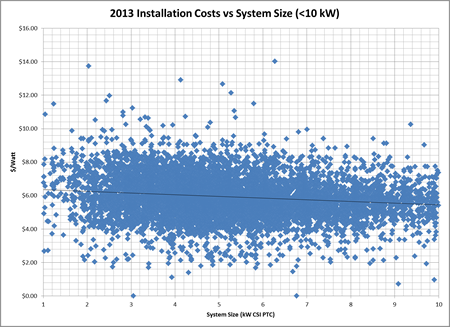

Finally, we turn to the question of size, and in particular how well does the size of a project drive down its cost? For this analysis (and most of our analyses going forward) we are excluding delisted and wait list projects from our data. Here’s our result for systems at or below 10 kW:

As in the past, we had to exclude a couple of outliers above $15/Watt: the farthest out there was Sun Pacific Solar Electric which charged $21/W for a 1.5 kW system and right behind was California Solar who installed a 7.9 kW project for over $16/W! We will have lots more to say about such Outliers next week.

As in the past, we had to exclude a couple of outliers above $15/Watt: the farthest out there was Sun Pacific Solar Electric which charged $21/W for a 1.5 kW system and right behind was California Solar who installed a 7.9 kW project for over $16/W! We will have lots more to say about such Outliers next week.

Overall, the trend is clearly moving in the system buyer’s direction with the trend line reaching down to $5.40/W for systems sized at 10 kW, while a typical residential project of 5 kW comes in around $5.70/W.

Nevertheless, that is a very gradual slope indicating that prices are fairly consistent across system sizes in this program segment.

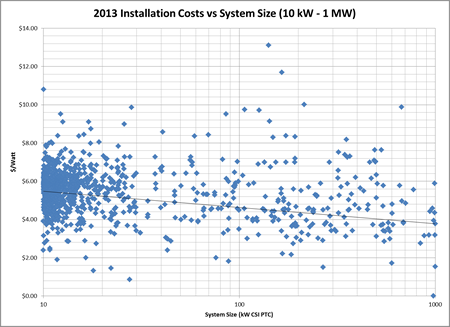

What about larger systems, do we see more of a downward trend there as system sizes increase? Here’s the data:

Interestingly, for the smaller projects there is very tight clustering right around the $5.70 mark where the trend line begins. However, as you move up in system size, the clustering breaks down and system costs vary far more widely than they do for smaller systems. Still the trend has 1 MW projects coming in around $3.77/W, compared to nearly $5.20 last year.

Interestingly, for the smaller projects there is very tight clustering right around the $5.70 mark where the trend line begins. However, as you move up in system size, the clustering breaks down and system costs vary far more widely than they do for smaller systems. Still the trend has 1 MW projects coming in around $3.77/W, compared to nearly $5.20 last year.

Ok, that’s enough to get us started. Monday we will report on Who’s Hot and Who’s Not, and Tuesday will be our favorite post: Outliers and Oddities. Stay tuned!

07/03/13

Categories: Solar Economics, Commercial Solar, Non-profit solar, Westridge PAC Project

Westridge Case Study: Part 3 - Advice to the Solar Reluctant

In Part One of this three-part Case Study we learned how Westridge School chose Run on Sun as their solar contractor. Part Two followed the actual Construction and Installation process from the client’s perspective. Now we conclude with Part 3 - Advice to the Solar Reluctant.

Advice to the Solar Reluctant

A true and long-tenured operations man, Williams understands not every business has the same confidence in the value of large-scale solar installations and their ability to save real dollars. Sometimes, people on the ground are convinced of the legitimacy of solar but may run up against superiors still reluctant to make a long-term investment. To those people, Williams gives this advice:

“Don’t think short term, think big picture,” he says. “Look at the numbers in a way that you’re truly aware of the value of sustainable energy and how important it is.”

The facilities director advises others in his position to help decision-makers understand having a solar installation is a way to add value to a company and separate a business from competitors in a way that is meaningful to customers. People will likely support that company by continuing to give it business, especially if the cost savings can be passed on to them.

The facilities director advises others in his position to help decision-makers understand having a solar installation is a way to add value to a company and separate a business from competitors in a way that is meaningful to customers. People will likely support that company by continuing to give it business, especially if the cost savings can be passed on to them.

Addressing the upfront costs is one of the biggest challenges, Williams admits, but it’s large-scale projects that offer the best and fastest ROI. When talking to a supervisor, or whoever is responsible for making the decision to invest in a system, speak to the facts. Have your data prepared and on-hand, and be prepared to show concrete evidence that solar would be a worthwhile investment, he says.

Even after a business decides to go solar, there are several more opportunities to remind higher-ups that the decision was a wise one. After installation, data collected from monitoring the system can show the direct benefits to others in the company and create a culture of awareness about the overall benefits of moving toward sustainability. When Williams receives the PWP rebate, he plans to take the paperwork straight to the school’s asset management department.

“Once you estimate the legitimacy of it, don’t let people forget about it. Remind them it’s still working,” he suggests.

‘Surgere Tentamus’

When Westridge School for Girls was first founded in 1913, women were not allowed to vote. Despite that fact, founder Mary Lowther Ranney, a well-known architect and teacher way ahead of her time, envisioned a place where young women could rise to new heights. Today, a full 100 years later, Westridge’s motto, “surgere tentamus,” Latin for “We strive to rise,” says a lot about the legacy of its founder.

The decision to make sustainable improvements to the campus stems from that vision, and in that way, Williams says, the new solar installation is the perfect bridge between the school’s rich founding principles and its desire to bring state-of-the-art green technology to the campus and the classroom.

He acknowledges how fortunate Westridge was to have students and parents who supported bringing solar to campus and were willing to give funds to the school for completion of the project. Now, when students lead group tours, they point to the south-facing roof of the Fran Norris Scoble Performing Arts Center and proudly let visitors know a fully-operational mini-power plant is running, unseen, above their heads.

Williams encourages others in positions like his to research the many potential benefits of solar. Seriously consider the different providers available, and choose the one who can give you the best value for your investment, because quality means more efficiency, more power and more savings.

In his case, he acknowledges his good own good fortune in finding support for solar. “There are a lot of smart people here,” he says. “When you speak intelligently to smart people, good decisions tend to be the result.”

The preceding is an excerpt from Jim Jenal’s upcoming book, Commercial Solar: Step-by-Step, due out this summer.

07/02/13

Categories: PWP Rebates, Commercial Solar, Non-profit solar, Westridge PAC Project

Westridge Case Study: Part 2 - Run on Sun Gets it Done!

In Part One of this three-part Case Study we learned how Westridge School chose Run on Sun as their solar contractor. Here in Part Two we focus on the actual process of the installation as seen from the client’s perspective.

Run on Sun Gets it Done

With the paperwork filed and the rebate secured, Run on Sun had a very tight window — less than two weeks in April 2012 — in which to install and connect all 209 solar modules and get the monitoring software up and running. The goal was for the project to be completed and operational by the time Westridge students returned from Spring break, so time was of the essence.

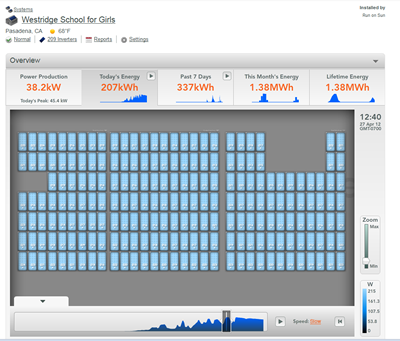

For the rooftop display Run on Sun used a microinverter system supplied by Enphase Energy, which allows customers and solar installers to track the output of the modules, individually or collectively, from the convenience of their computers, iPads or smartphones. This software was a selling point for the school, because it would make the technology accessible to students and allow teachers to creatively incorporate aspects of the solar system’s performance into classroom instruction.

For the rooftop display Run on Sun used a microinverter system supplied by Enphase Energy, which allows customers and solar installers to track the output of the modules, individually or collectively, from the convenience of their computers, iPads or smartphones. This software was a selling point for the school, because it would make the technology accessible to students and allow teachers to creatively incorporate aspects of the solar system’s performance into classroom instruction.

The modules were grouped into three sub-arrays that formed a larger circuit. Under each module, a microinverter was installed to convert DC energy gathered from the module into AC power, which could be combined and fed back into the school’s electrical service. The 1:1 ratio of microinverters to modules allows for a more detailed readout that lets users know the output of each module and gives an easy-to-read display should anything ever go amiss, from a connection issue to dirt on the module’s surface.

Throughout the installation Williams remained on hand to oversee the work, though there were no delays and no change orders requesting funds beyond what had been originally estimated. Within the assigned two-week period, Run on Sun had completed the project on time, and everything was in working order.

“I’ve worked with a lot of contractors, and I can honestly say, in this situation, this was one of the most seamless projects we’ve ever completed,” Williams recalls. “They were here early on the first day and, boom, they got it. It was done on schedule, at the price they said and signed off by the city. I wouldn’t hesitate to do a project like that again.”

A Truly Happy Anniversary

April 2013 marked the one-year anniversary of Westridge School’s solar installation, and Williams reports the system is running smoothly. The Enphase software makes it easy for officials, teachers and students to monitor the activity of all 209 modules, but Run on Sun also keeps a close eye on the operations and reaches out if and when an anomaly is detected. In the event that an outage or a decline in energy production should occur, the company promptly notifies the school.

For example, when one of the modules stopped reporting and apparently needed to be replaced, Run on Sun immediately contacted Williams to schedule a visit. The rest of the modules were still in full working order, and upon close inspection it was revealed that a connection had come loose. Still, to ensure maximum performance, the company replaced the microinverter at no cost to the school.

Another time Williams received a notification email from Run on Sun after the campus Internet connection had been temporarily cut during some service upgrades. And when the energy dipped from its norm of exceeding system predictions to 98 percent of anticipated, a call came in with a recommendation to check the array for accumulated dirt. After a brief spray with a hose, the system was back to producing at maximum capacity.

At the one-year mark, the school became eligible to receive its first annual rebate from Pasadena Water and Power. This is the first of five annual rebates it will receive, the dollar amounts directly correlated to the system’s actual production.

When a technician came from the city to assess the energy output of the system, the school was excited to learn the results. The city’s readings gave some very welcome news, indeed — the energy generated by the installation was above and beyond the original estimate provided to PWP, and it looked like the first rebate would be larger than anticipated.

“He said, ‘You’re over your estimate,’ and that’s all we could ask for,” says a thoroughly pleased Williams. “To date, everything that was promised to us was delivered — plus.”

In terms of the amount of energy generated, the rooftop system has continued to outpace expectations. The school expected to see a return on its investment in seven years, but it’s shaping up to come in as few as six. Because of the installation, Westridge is using 30 percent fewer kilowatt hours and is seeing its bills reduced by thousands of dollars each month, in addition to the rebate. The overall savings is far greater than the cost of running the air-conditioner in the gym, the initial impetus for bringing solar to campus. To Williams, making the decision to go solar was a “no-brainer.”

“The neat thing about this is it runs itself. If somebody walks onto campus, they don’t know we have a 52 kilowatt solar system on campus,” he adds. “They don’t see it. It doesn’t impact anything. All you do is save money.”

We will conclude this three-part Case Study with Part Three - Advice for the Solar Reluctant.

The preceding is an excerpt from Jim Jenal’s upcoming book, Commercial Solar: Step-by-Step, due out this summer.

05/31/13

Categories: Solar News, Commercial Solar, Safety, Ranting

Does Quality Sell?

Nothing like a piece in the New York Times questioning the reliability of some solar modules to get tongues wagging and some pointing fingers at “Chinese dumping” while others tell us that solar technology is just not ready for prime time. To us it raises a different question - does quality sell?

The article, titled Solar Industry Anxious Over Defective Panels, points to installations as close as the Inland Empire, having shockingly high failure rates after just two years of being installed. “Coatings that protect the panels disintegrated while other defects caused two fires that took the system offline for two years, costing hundreds of thousands of dollars in lost revenues.” Wow - that is shocking. So who made those defective panels? The reporter doesn’t say.

Nor are any of the problem panels alluded to in this story ever named, citing, in some cases, confidentiality agreements.

Which raises a serious problem with the article: if you cannot identify any of the solar module manufacturers that are having these problems you leave the impression that all solar modules are suspect. (Our analysis on who the guilty party might be is below…)

A quick perusal of the comments to the article reveals the predictable factions: those who echo the Fox News line that solar is a failed technology that only exists because of the Obama Administration’s foolish indulgence in Green Tech; claims that all problems in the solar industry are a result of “Chinese dumping” and the associated China bashing; countered partially by a handful of comments from people who actually know something about the industry.

We find the Chinese bashing particularly problematic - after all, the Chinese are not putting a gun to any project developer’s head and forcing them to use third-tier panels.

Greed is what is causing that.

We have been in business since 2006 and there have always been high quality solar panels available from reputable manufacturers - and they have always cost more than many of the panels offered to us for use in our projects. Scanning the CSI data (see below) reveals that many projects - including many of the largest projects - were built using those “bargain basement” panels. Why? Because it maximized the project developer’s profit.

This is not a new problem, despite it getting a major splash in the “Paper of Record." Indeed, we wrote in the Spring of 2012 about how the decision by project developers to focus on the lowest cost per Watt “will continue to put undue pressure on quality manufacturers around the globe - whether in the US or China. Consumer demand for quality is the ultimate way to improve this situation - and that means educating consumers as to what quality means in this market." A year plus has gone by, but where has that educational effort been? The need is as great - or greater than ever, but sadly, the NY Times piece fails on that score. (If you want to read an earlier, and far more comprehensive article on this subject, check out this piece by the great Felicity Carus: Quality Issues Threaten to Give Solar a Black Eye.)

What’s Up in the Inland Empire?

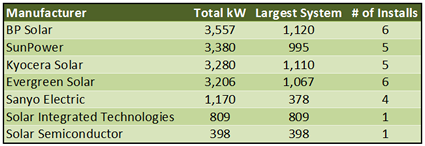

It’s a Friday morning so we decided to indulge in one of our favorite pastimes and go diving into the CSI data to see if we could identify the guilty party alluded to in the NY Times piece. Here is all they gave us to go on - the project has been in place for roughly four or more years (failed after 2 years, offline for 2 years), located in the “Inland Empire” and its downtime resulted in a loss of “hundreds of thousands of dollars” in revenue. From that we concluded that we needed to look at systems from 2010 or earlier, in the Inland Empire - which we took to mean anywhere in the counties of Riverside or San Bernardino - and of at least 200 kW. Those criteria provide us with 28 potential systems, built with solar panels from just seven manufacturers. Here are our results:

What can we say about these manufacturers? Well, certainly BP Solar, SunPower, Kyocera and Sanyo would all be considered top-tier manufacturers of solar panels - although BP is exiting the solar industry and Sanyo is now owned by Panasonic.

As for the others, Evergreen Solar was a US manufacturer that filed for bankruptcy in August 2011. Solar Integrated Technologies was a subsidiary of Michigan-based Energy Conversion Devices which itself filed for bankruptcy in February 2012. Solar Semiconductor is a vertically integrated systems provider with manufacturing facilities in India.

So who is the guilty party? No way to know for sure, but a little online searching reveals other problems for one of these companies. A September 14, 2012 article on the San Diego Union Tribune website documents problems with “Flawed Solar Panels” that were manufactured by Solar Integrated Technologies. According to the article, the panels manufactured by the company, “had a manufacturing defect that allowed water to seep into crevices of the panels, which in some cases created corrosion and in the worst-case scenario could cause a short that could start rooftop fires” - which sounds a great deal like the problem cited in the New York Times piece.

05/23/13

Comparing Solar Bids - Part 3: Utility Savings Analysis

In Part 1 of our series on Comparing Commercial Solar Bids we looked at how to distinguish bids based on the Solar Modules proposed. Part 2 did the same for Solar Inverters. Now our four-part series continues, looking at what to expect from a Utility Savings Analysis.

You want to know what your savings will be from your new solar power system and this analysis should answer that question. A proper Utility Savings Analysis must do three things: predict the amount of power the system will produce both peak and in terms of energy over time; assess the value of that production in Year 1; and apply appropriate factors to assess the change in value of that production over the lifetime of the system. Let’s break this down.

Power and Energy Production

The peak power and energy yield from the proposed system in Year 1 is a function of system and environmental factors. The system factors include the modules and inverters chosen (including all of the variables discussed previously).

The environmental factors consist of the azimuth (orientation relative to true North), the pitch of the array and any shading factors that might be present. If the overall array is comprised of sub-arrays with different environmental factors, then each sub-array must be assessed separately.

For a so-called “fixed-plate array” – that is a solar array that is at a set azimuth and pitch (which is typical for commercial installations) – the ideal azimuth in terms of annual energy yield is due South and the ideal pitch is the latitude of the site. While deviations from these ideal values will result in reduced annual energy yield, in the real world such deviations, are common. Indeed, in some settings a deviation might be desirable if, for example, summertime performance is to be maximized (perhaps to mesh with the payment profile of a feed-in tariff program), in which case a flatter array pointed more to the West might be selected.

Regardless of the azimuth and pitch, shading is to be avoided, especially if string or central inverters are used. When a string of solar modules are wired together, shade falling on one module not only degrades the performance of that module, it will degrade the performance of the entire string. This in turn will degrade the performance of the entire sub-array of which that string is a part. (Microinverters overcome this problem because each module operates independently – a shaded module still sees its performance deteriorate, but that deterioration has no effect on the adjacent, unshaded modules.)

All of these factors, as well as the geographic location of the system site, are then provided as inputs into a PV system performance model – the best known being PVWatts, created by the National Renewable Energy Laboratory (NREL), and used as the underlying mechanism of many utility rebate calculators, such as the CSI rebate calculator. The output from the calculator will provide a value for the peak output from the system (in AC Watts) and the energy yield profile over a year – either month-by-month, or even hour-by-hour.

Savings in Year 1

Knowing the production profile for the proposed system is just the first step in the Utility Savings Analysis. The next crucial step is to calculate the savings from that production in Year 1 – the first year the system goes live. To do this accurately requires a detailed analysis of the relevant utility rate structure and possibly detailed information about how the existing loads at the site behave. A simple-minded analysis that assumes that all kWh’s of energy are worth the same fails to meet this standard and will not accurately predict the savings to be achieved.

Most commercial solar customers pay for both total energy usage and peak power demand. To accurately determine savings requires a clear understanding of how the solar power system will affect both of those components. Unfortunately, it is not uncommon that the data necessary for such an analysis will be incomplete or missing altogether.

Savings from usage reduction, by comparison, are easy to calculate – if you have past usage data (pretty much always available except for new buildings or new utility customers) and a properly designed rate structure model, it easy to apply the energy yield profile from the performance calculator to the rate structure and determine savings. For customers on usage only rate structures, this provides a nearly perfect estimate of annual savings as of Year 1.

It is in trying to determine how the solar power system will alter demand charges where things get complicated. To do this accurately – and honestly – requires hour-by-hour demand data so that the client and the solar contractor know when peak demands occur. If the peak demand occurs at high Noon and is driven by HVAC loads, the solar system will directly reduce that peak – perhaps by the full value of the solar power system’s output. Conversely, if the peak demand occurs at eight o’clock in the morning – say, when the first shift arrives – the solar power system will have next to zero effect on peak demand.

Unfortunately, unless the potential client has been on a time-of-use based rate structure, such data is almost certainly unavailable.

Under those circumstances client and contractor have only two choices: gather the data as part of the site evaluation process (by temporarily or permanently installing data logging equipment), or make a well-documented estimate (also known as a wag) of what the effect of the solar power system will be on peak demand. The client should insist that all of its bids use the same estimate.

Fortunately, relatively inexpensive data logging equipment is now available and it should be used whenever available decision-making timing permits. A contractor who refuses to provide such a service – for a fee, of course – should be scratched from the list of potential candidates.

Savings Over System Lifetime

So now you have an estimate of your utility savings in Year 1 – how can you determine what your savings will be over the lifetime of the system? After all, that is the key question in determining your ultimate Return on Investment.

To answer that question requires figuring out two more puzzle pieces – one straight-forward and the other unavoidably controversial. The straight-forward puzzle piece is how will the system’s performance will change over time. This is straight-forward because we have reliable data for making that prediction. Assuming reasonable maintenance for the system – cleaning the modules occasionally, replacing broken modules or repairing faulty inverters, etc. – the performance from one year to the next is really a function of the deterioration in the performance of the solar modules installed. That rate will be documented in the performance warranty of the module, and hence it will be easily modeled. (For modules that guarantee 80% of nameplate power after twenty-five years, that works out to a degradation factor of ~-0.9%/year.)

The controversial puzzle piece is in guesstimating what will happen with utility rates over the lifetime of the system. Not only is this a difficult task at best, it has even lead to class-action litigation when solar leasing giant SunRun was sued for over-estimating (according to the Plaintiff) the magnitude of utility rate increases in the future.

Over the years solar companies have used annual rate increase factors ranging from 6.8% (almost certainly too high) to 3% (almost certainly too low, at least in California). SunRun was sued for picking 6%, and yet in 2012 SCE secured a three-year, 17.2% average rate increase – which works out to 5.7%/year!

So what is the right number to use? At Run on Sun we generally use 4.5% for municipal utilities and 5.7% for SCE. But in our view, the rate selected is not as important as the need to clearly disclose the rate being used in the model. If that is done, the client is free to do their own calculation with a different rate or to insist that all potential bidders use the same rate. At the very least, such disclosure should render lawsuits such as the one facing SunRun moot.

However the rate is determined, and ultimately disclosed, the result should be a series of values for how much savings will be generated by the system for the next twenty-five years. Now you are ready to receive your payoff analysis – that demonstrating your anticipated Return on Investment and LCOE, the topic of our final installment.

The preceding is an excerpt from Jim Jenal’s upcoming book, “Commercial Solar Step-by-Step,” due out in July.