Category: "Commercial Solar"

08/29/11

Categories: All About Solar Power, Solar Economics, SCE/CSI Rebates, PWP, SCE, LADWP, Commercial Solar, Residential Solar, 2011

The State of Solar California - What Does the CSI Data Reveal?

The California Solar Initiative (CSI) is responsible for overseeing solar rebates for California’s three Investor Owned Utilities (IOUs): PG&E, SCE and SDG&E, and in that role the CSI program collects some very interesting data. As we have in the past, we decided to dip into the data from the first half of this year to gain some insights into the State of Solar in California. Over the next several days we will be reporting on what we have learned - and there are some very surprising things in here to be sure!

Overview & Methodology

A word first about how we processed the CSI data. We downloaded the most recent active data set as of this writing (the August 24, 2011 data set to be precise) and parsed it into Excel. Since we were only concerned about systems in our service area, we excerpted out just the data from SCE. To narrow our focus more, we wanted to only look at applications that had significant status during the first half of this year. The CSI data has a host of date fields - we took the latest of the fields ranging from First Reservation Date to First Completed Date as our Status Date and excerpted those that fell between 1/1/2011 and 6/30/2011 - a total of 6,306 data points.

That’s a fair amount of data but it necessarily omits any data at all from the municipal utilities such as Pasadena Water & Power (where we do much of our work) or LADWP. Unfortunately, none of the munis make their program data generally available - which is particularly odd given that the local residents actually own those utilities (and thus, their data) - but that is a topic for another day.

Finally, for the purpose of these posts, all system sizes are reported in CSI Rating AC Watts (to account for differences in equipment choice and system design) as opposed to DC (or nameplate) Watts.

What can we say about those 6,306 projects? Collectively they account for 164.7 MW of new solar power at a total installed cost of just over $1 billion - with incentive amounts totaling $219 million - roughly 21% of the installed cost. Unfortunately, not all of those are built - or even ever will be. Fully 11% (698) of those projects have the status ‘Delisted’ - meaning that they have been cancelled for one reason or another. Those delisted projects account for 37.8 MW of potential solar power that presumably will never see the sun. (Do some installation companies have a significantly higher rate of “delisted” systems? We will answer that question in a subsequent post - stay tuned!)

The remaining 5,608 are split between “Installed” and “Pending” with 55.8% (3,131) installed and 44.2% (2,477) pending. Breaking that down a little more, the installed projects account for 33.8 MW worth $240.1 million with incentive amounts totaling $57.1 million. In contrast, the pending projects account for almost three times as much capacity at 93 MW worth $575.8 million with incentive amounts totaling $120.6 million. (That is, nearly three times the to-be-installed solar cpacity for roughly twice the rebate dollars.) On average, installed projects cost $7.09/Watt whereas pending projects cost $6.19/Watt - a positive trend for consumers since it shows the cost of solar power systems declining over time.

Does Bigger = Lower Cost?

Finally, for today, let’s examine whether the data supports the notion of solar economy of scale - that is, as system size increases does the installed cost/Watt decline? To get a handle on that, we took two different cuts through our data set - “small” installed or pending systems <10 kW, and “large” systems ranging between 10 kW and 1MW.

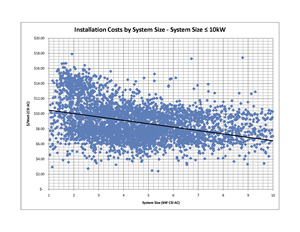

First, here’s the graph for the “small” systems (consisting of 4,992 installed or pending systems - click on the graph to view full size). As the trend line makes clear, larger systems really do drive down costs - decreasing from over $10/Watt at the small end of the range to just above $6/Watt for systems around 10 kW.

First, here’s the graph for the “small” systems (consisting of 4,992 installed or pending systems - click on the graph to view full size). As the trend line makes clear, larger systems really do drive down costs - decreasing from over $10/Watt at the small end of the range to just above $6/Watt for systems around 10 kW.

Another interesting observation from this graph are the outliers - with some data points below $3.00/Watt (mostly from self-installed system) all the way up to nearly $18/Watt!!! (We will have way more to say about those data points - and who is responsible for them - later in this series.)

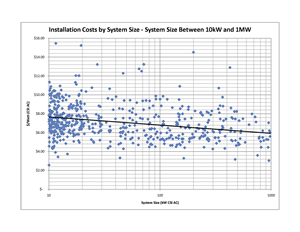

If we now look at larger systems - those between 10 kW and 1MW - our data set has 587 such systems and again, the trend line shows the decline in system costs as system size increases. (Note, because there is such a huge range in system sizes on this graph, we plotted the system size on a log scale.) Some of these outliers are also pretty curious - a 200 kW system coming in at over $14/Watt?

Of course, this data is showing what happens when an individual project gets larger and there the trend is clear. One might well ask, does the same trend apply to larger installation companies? In other words, as a company has more and more installs, does that economy of scale translate into lower costs for the end consumer? That’s a very interesting question and the answer - coming in our next post - just might surprise, or maybe even disturb you.

If there are some other cuts of this data that you would like to see, just let us know in the comments. Trust me, we are just getting started!

06/19/11

Categories: All About Solar Power, Solar Economics, Solar Rebates, Solar Tax Incentives, Solar News, Commercial Solar

Does Solar Have a PR Problem?

A recent article in USA Today/CNBC online asks the question, “Does the solar industry have a PR problem?" Yes, concludes the article, and that bad press is well justified because “solar technology is not quite ready for prime time". Well, if the USA Today article is any indication, the solar industry clearly does have a PR problem, but it is not because of any failure in existing technology. The failure, rather, is in media reporting that allows interested parties to speak as experts who denigrate existing solutions, without ever bothering to disclose the expert’s inherent conflict of interest, or even to report on the facts as they pertain to actual solar clients.

There can be little doubt that those of us who believe in the benefits of solar power systems have done a poor job of informing the public about the value of solar today. (This blog, and the writings of folks like Tor “SolarFred” Valenza notwithstanding, there is a great deal of work to be done on this front.) So it is hard to argue with the general proposition that solar has a PR problem - as in not nearly enough PR to counter the spin coming from the naysayers and the apologists for the status quo.

But the article takes a different tack. It quotes at length from someone named Jim Nelson, the CEO of solar start-up Solar3D, to explain why solar has earned its bad rap:

The problem, says Nelson, is that solar is generally still not price competitive with fossil fuels for energy generation, says Nelson [sic]. Paradoxically, government efforts to subsidize the purchase of solar panels actually slow down the adoption of innovation that should ultimately make renewable energy more affordable.

By encouraging consumers to buy immature and inferior solar technology right now, government subsidies risk locking people into solar systems that are inefficient, expensive, and may or may not ultimately pay off to the consumer. “They’re encouraging people to use things that don’t work,” he says.

At current kilowatt-per-hour rates, solar energy costs about 4 times more than power drawn from the grid, says Nelson.

Wow. Lots of troublesome statements in that blockquote. Let’s break this down and see what’s what.

First off - what do people actually pay for electricity from their utility versus from a solar power system? In Run on Sun’s southern California service area, the actual loaded cost of electricity ranges from $0.15 to $0.29/kWh. For a commercial solar client, the cost per kWh - after allowing for rebates, tax incentives and O&M costs - is around $0.11/kWh. These are the real world costs and benefits for clients adding solar right now. For a 50 kW commercial installation, that translates into payback occurring between years 4 and 5 with an internal rate of return over the 25 year lifetime of the system of 17% or more. Moreover, every year the client’s savings will grow as the cost of electricity from the utility continues to rise while the cost for electricity from their solar power system remains constant.

Second - solar today is far from something that doesn’t work. To the contrary, solar power systems work day in and day out with minimal maintenance beyond occasionally directing a hose at the panels to clean them off. True, inverters will likely need to be replaced about halfway into the 25 year lifetime of the system (although newer designs like the Enphase M215 micro-inverter are now pushing inverter lifetime far beyond older products) but that cost is part of the O&M cost considered above. While solar panels will degrade over time, modern panels are warrantied to produce 80% of their rated power after 25 years and even older designs are still operating just fine after 40 years. What other major asset can a business owner purchase that will pay for itself within five years, require minimal maintenance over its entire lifetime, and still be working well after 25 years? Oh, and save the business owner many times over the initial investment during those 25 years?

Too bad more things “don’t work” as well as a solar power system.

Finally, what is Mr. Nelson’s perspective on all of this? The article describes his company as a “solar manufacturer” but manufacturers typically have products for sale. Touring the Solar3D website reveals lots of PR, but no products. Rather, Mr. Nelson’s company, “Solar3D, Inc. is developing a breakthrough 3-dimensional solar cell technology to maximize the conversion of sunlight into electricity." The key phrase being, “is developing".

Now we are all for more efficient solar technologies being developed into real-world products that we can put on roofs. We sincerely wish Mr. Nelson well in his efforts to bring ever better products to market. But it is just silly to tell the solar-buying public that present technology is “immature” and “doesn’t work” when Gigawatts of installed solar power systems prove just the opposite. And it is sloppy journalism to quote him without revealing his true position in the industry.